A little while back I did a guest post on the Wolf of Harcourt Street’s blog on ETF investing. WOHS is an Irish based investor who is building his way to financial independence with growth and value stocks rather than ETFs. This post goes through his:

- Investing strategy

- Tax considerations

- Due diligence when picking stocks

- Tips for someone trying to follow this strategy

As well as how you can follow along his journey and get access to his newsletter.

Thanks WOHS for this insightful post. I hope it gives readers some food for thought on other investment strategies and considerations here in Ireland.

My Investing Strategy

My investing strategy revolves around investing in a combination of growth and value stocks. First off, what is the difference between a growth and value stock?

Growth stocks are companies that come with a significantly higher growth rate compared to the average growth rate in the market. This means that the stock grows at a faster rate than the average stock in the market, consequently generating earnings at a faster rate. Growth stocks have the potential to achieve high earnings growth but have not established a history of strong earnings growth. Growth stocks concentrate on growing their revenue often at the cost of delaying profitability. Examples include Amazon, Facebook, Tesla.

Value stocks are companies that are being traded at a value lower than their intrinsic value. This means that value stocks are being traded at a price lower than their true value and are therefore undervalued. Value stocks are usually larger, more well-known companies that are trading below the price that analysts feel the stock is worth, depending on the financial metrics that it is being compared to. Examples include Coca-Cola, McDonald and Procter & Gamble.

If you are interested in learning more about the difference between growth and value stocks check out Growth vs Value.

Tax Consequences of Investing

My investing strategy is designed to minimise the amount of tax that I pay over the long-term so that I can maximise the effects of compounding. As a result of this, I do not invest in any ETFs and I try to limit my exposure to dividends. Investing related tax can be summarised as follows:

- Individual stocks – CGT of 33% – €1,270 annual exemption

- ETF/Index funds – Exit tax of 41% on gains – no annual exemption

- Dividends – Marginal rate of up to 52% – no annual exemption

I am a full time PAYE employee taxed at the marginal rate of 52% on any additional income I earn such as dividends. As an example, €100 worth of dividends results in only €48 in my pocket. Looking at ETFs, €1,000 worth of gains results in only €590 in my pocket. With ETFs you also have the added headache of calculating the deemed disposal. For comparison, €1,000 worth of capital gains in a tax year results in €1,000 in my pocket based on the current tax rules. If you want to know more about the tax consequences of investing check out the Let’s Tax About Tax Series.

Due Diligence

Investing in individual stocks means that I have committed to spending a lot of time on research and analysis. This strategy is not for everyone. I have chosen the active investing route because I have a passion for studying and researching individual stocks, I am willing to put the time in because I view it as a hobby and I like being in full control of my own finances. Additionally, I can see the tax benefits compared to other strategies. Decide what works best for you. If you are not interested in individual stocks or do not have the time to spend on research then passive investing in ETFs might be more suitable for you.

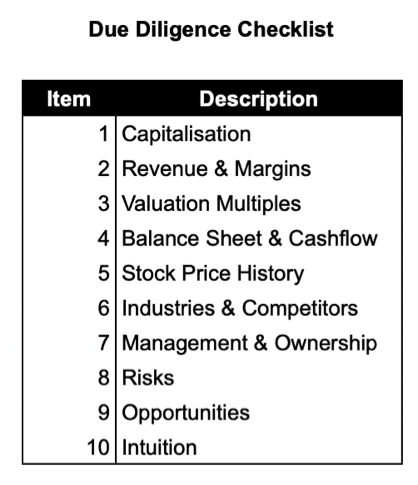

When performing stock research I follow a Due Diligence Checklist. The idea behind this checklist is to ensure that I do not skip over or miss any important areas of focus. Below is a summary of the items included:

My due diligence process can take days or weeks depending on how familiar I am with the company already and of course balancing a full time job. Check out the most recent investment thesis I published on Square, Inc for an example of this process put into practice.

Implementing a Similar Strategy

Are you someone who is looking to move from a passive investing strategy to an active investing strategy? Establishing your investing goals and an emergency fund are two other really important aspects to investing. This is something every investor should do regardless of whether you invest in ETFs or individual stocks. This 5 Point Framework can help you to get started investing. For current investors, it can also serve a role in validating whether your actions to date are consistent with your long term goals or if changes are required.

Defining your risk tolerance is what ultimately separates growth from value investors. Growth stocks are more volatile than value stocks by their nature. I personally adopt a 70/30 split between growth and value stocks. I am a long-term investor with time on my side so I am prepared to buy and hold quality high growth businesses through volatility in the hope of achieving outsized investing returns. If you would not be comfortable seeing your portfolio decline 10% or 20% in the short term then it might be best gearing more towards value stocks. You can view the current stocks I hold under My Portfolio.

Skin in the game will massively accelerate your learning when it comes to individual stock picking. By having a small amount of money on the table you will pay far more attention to the stock without often without realising. Start small and build your positions up over time as you become more familiar.

Lastly, but most importantly, always do your own due diligence. Advances in modern technology mean that it has never been easier to be a retail investor. The most accurate and up-to-date information is at our fingertips and is just as accessible to you and I as it is to the largest investment bank. There are a lot of really useful websites and accounts that share investing information for free. However, never follow another individual blindly. Every investor is operating under a different set of circumstances and with different goals to you. The only person that is responsible for your investment decisions, is you.

My Newsletter

I write a free weekly newsletter with the mission of making investing knowledge accessible to all. Whilst I am far from an expert, I was inspired to start the newsletter because I found that many people with less financial literacy than myself really struggle to know what to do with their hard earned cash.

By documenting my portfolio insights, stock analysis and learnings I hope to inspire others to start investing and take control of your financial future. I would estimate that I spent about 10 hours a week writing content for the newsletter and twitter account @wolfofharcourt

Sharing information in the public domain can have its drawbacks too. Everyone has got an opinion and that can differ from your own. Ultimately, this is what investing is all about – every time you buy, somebody else is selling and both parties think that they are going to profit from the transaction. I try to be as transparent as I can with my readers. If you like what you have read you can sign up to my free weekly newsletter here.

I don’t know if wolf is planning on replying to comments but I have a question for him:

I don’t hare time for an active investment strategy, but I would obviously prefer to avoid as much tax on investment as possible. I have thought of a pseudo-passive strategy.

I could pick an etf fund that I would like to invest in, but instead of investing in the fund directly, invest in the same stocks that the fund invests in. You say in your article not to copy an individual investor, but this would be copying an ETF fund rather than an individual investor.

The funds publish what stocks they hold and its usually list them in order of the percentage of the total value of the fund. So let’s say a funds value is comprised of 5% apple, 3% Microsoft, 2% nestle etc… I could start by buying one share of apple, one share of Microsoft, one share of nestle. Then continue on down the list until I’ve bought one share of each holding. Of course the downside of this is that you then have an equal amount of shares of Apple and nestle, and depending on stick price you might have invested more money in nestle than in apple. And if I was to continue blindly down the list forever I would own the same number of shares of Tha funds smallest holding as of its largest. So once I’ve reached one share of each stock that makes up 50% of the value of the fund. I would then look at the actual amount invested in each and adjust by adding more shares of the larger holdings / lower prices shares, until the percentage value of my investments matches more closely the etf. Then once I’ve achieved that I would go back to the list of holdings in order and add more of the smaller holdings, then when I’ve reached 75% of the funds total value, rebalance again. The more money I invest the more closely I could approximate the holdings of the etf. I would not be doing all this in real time of course, I would be making a shopping list in excel until I’ve allocated all the money I have to invest at a time. I would buy and hold each share and any readjustment would be done by buying more of other shares not by selling.

This would also allow me to easily exclude any company that doesn’t meet my personal ESG preferences.

Of course the biggest downside of this is the fees, as I would be charged for each company that i buy shares in, rather than buying an etf for free from degiro. But the tax savings are a minimum of 8% (41 – 33), and in reality a lot more due to the first a thousand or so exemption, so that should offset the cost of fees for any share where the fee is less than 8% of the cost of the purchase.

As two investors with opposite strategies (mmh and wohs), what do you guys think of this?

Hiya, Interesting idea, I’ve considered this approach myself but ultimately ruled it out due to the fees on purchase and sale and the effort required to maintain the balanced and diverse portfolio and I was only looking at buying the top 10 stocks individually. If you want to buy 50% of the stocks of VWRL for example, you will have to buy about 150 individual company stocks. That’s a lot of fees on purchase (at least 300€ in flat fees and percentage of the purchases) and again on sale when you want to rebalance. Also you mention the tax credit but that is a use it or lose it credit in that you only claim that credit when you sell and actually make a gain, so it will not be of benefit during accumulation but will do well in the drawdown phase. Those company’s also have dividends which are going to be taxed at 11% MORE than an ETF if you are in the higher tax bracket (52%) while you are accumulating. With an accumulating ETF you only pay 41% on the dividends and only in year 8 which allows you to compound for the first 8 years. Individual stocks pay out dividends from year 1 so you pay taxes on those which reduces compounding. I did a post comparing a stock portfolio to an ETF portfolio taking all things into consideration and the ETF portfolio was only 0.3% less than the stock portfolio in the long run so I’m willing to take that hit in an effort to free up my time and effort and risk on maintaining a portfolio of 150 stocks to save on taxes on gains (but not on dividends), if that makes sense? Also, when it comes time to withdraw, how do you manage that with 150 stocks, do you sell just one company’s stocks to fund your expenses for year 1, then a different company for year 2 etc? My personal mantra is that I don’t care if I have 1 million or 10 million, as long as I have enough to cover my cost of living that’s enough and I’ll choose simplicity of execution and maintenance over potential tax savings any day. If you are saving 50% or so of your income per year, your time to FI won’t change that much regardless of which approach you take as the growth is mainly from your contributions and not the growth or taxes. That’s my take on it.

Thanks a million for replying Meagan. I guess this isn’t really a workable solution.

Im going to start looking into investment trusts next as I believe they are similar to etfs but taxed a bit more favourably.

Thanks again for your advice.

Hi Kirsty,

Thanks for reading! I think trying to mirror a fund would be quite time consuming as they often rebalance and this would mean you might need to transact far more than you’d like but I certainly understand where you are coming from.

A similar but alternative method would be pick 25 blue-chip stocks (nationally recognized, well-established, and financially sound companies eg Apple, Microsoft, Facebook etc) and stick 4% in each. To minimize fees you could just make one purchase each month so Apple in Jan, Microsoft in Feb, Facebook in March until you get to the end of your list then purchase your second lot of Apple and so forth. This is a complete made up example if it wasn’t already clear, you could change the total number of stocks and % allocations to preference.

I do think the tax benefits are significant especially over the long term. This is a great thread on Twitter that demonstrates the impact of Tax Deferred Compounding https://twitter.com/10kdiver/status/1396125686138490888?s=20

There is a definite time trade off however. It really does depend on how much time you can commit to investing activities. If you do not have the time or the interest in individual stocks then low cost ETFs might be the best option

I hope that helps,

WOHS