Wolf of Harcourt Street reached out to me to see if I’d do a guest post on my experience with investing in ETFs.

WOHS is a 28-year-old accountant working in the financial services industry here in Ireland. He started a blog to share his journey towards financial freedom investing mainly in a portfolio of 60% growth stocks and 40% value/dividend growth stocks. His mission is very much aligned with my own which is to make personal finance and investing knowledge accessible to all.

Full post below.

For anyone that’s come across the financial independence retire early (FIRE) movement, you’ve no doubt come across exchange traded funds (ETFs) as one of the preferred investment vehicles for people pursuing this in North America.

Cross to ocean to Ireland though and the tax landscape on ETF’s can seem prohibitive and unappealing.

So why am I still planning on building the majority of her passive income in ETFs?

This can be a bit of a long winded answer but essentially for my personal situation the pros still outweighs the cons, though my views of the world can be a bit unorthodox and will not suit everyone.

My current early retirement strategy is to pay off my mortgage as soon as possible and then invest more heavily in ETFs. I’m currently on track to pay off our mortgage in the next 2-3 years and then plan to build up an investment portfolio of 650k in the next 14 years on one-part time income. Our family of 3 in Cork is on track to spend only 30k this year and expect to go down to 26k/year once our mortgage is paid.

I’m a big fan of the keep it simple approach and ultimately keeping it simple and the ability to access my money at any time are the key drivers of ETF investing for me. All the other investment vehicles require more effort than I’m willing to put in.

My main drawbacks with other investment vehicles are:

- Stocks require research into the underlying company performance and valuation on an ongoing basis as well as having increased cost to purchase (stamp duty) and sell compared to ETFs. It also requires more effort to maintain and rebalance a well-diversified portfolio.

- Investment trusts while potentially performing better that ETFs and having better taxation on gains are a bit too risky for me in that you are investing in a company who invests on your behalf. If that company goes bust, your assets aren’t as protected as investing directly in the underlying funds. I wouldn’t be comfortable having a portfolio of over 100k in JUST investment trusts for example. They are also traded in GBX (British pence) and subject to currency exchange fees and fluctuation risk, which could wipe out any outperformance of an ETF portfolio.

- Pensions can be a very good way for people to catch up later in life due to the tax deferral incentives and being able to grow and compound tax-free seem like no brainers but my main issue is the access to the funds, the lack of transparency of fees and under performance. I plan on accessing my retirement funds as early as 45 all going to plan and having them locked in a pension doesn’t work for my personal goals. I know this may mean I will have a lower net worth in the long run but this is not my main goal. My main goal is to have financial freedom and security along the way should bad things happen or should we wish to change direction and put the money towards some other unknown life goal that may come our way.

- Investment property’s are not diversified, way too much effort (sourcing good tenants, keeping up with maintenance, renewing mortgage and insurance regularly etc), too high risk (potential vacancies, potential repairs that wipe out multiple years worth of gains), mostly cash flow negative while the mortgage is being paid down (very hard to find a rent ready property with high rental yields that more than covers the costs and taxes), and taxed highly while you are still earning. This is not to say people can’t retire early with property, it’s just not worth the effort for me personally. I’ve tried it and am so relieved to no longer have a second property to have on the back of my mind all the time.

If you’re up for a bit of number crunching analysis, you can check out these posts where I weigh up ETFs against a stock portfolio, investment trust portfolio, and pensions and see how I still keep coming back to ETFs.

So, if I’ve peaked your interest in ETFs read on to see

- what ETFs are

- the pros and cons

- how they are taxed

- my current portfolio make-up

- things I plan to change

- why I’m not invested in just one high performing ETF

- how to buy them

- my experience with filing and paying taxes on ETFs

Table of Contents

What are ETFs?

These are essentially funds that bundle a large number of individual stocks, commodities and / or bonds under one fund. This allows you to easily track the trend of the whole stock market with only a handful of ETFs. This makes it easy for passive/lazy investing over longer terms. ETFs also offer low expense ratios and fewer broker commissions than buying the stocks individually. Historically since the inception of the stock market returns have averaged 9-11%. By having a well diversified range of ETFs you can also achieve these levels of returns with little effort.

What’s good about ETFs

- Low cost management fees compared to active funds

- Low purchase/sale costs (no stamp duty)

- Passive investing for decent returns – buy and forget

- Good diversification

- Lower tax on dividends compared to individual stocks/investment trusts while you are earning above the 40% tax bracket

- Liquid as you can sell anytime

What’s bad about ETFs

- Higher tax on capital gains than individual stocks/investment trusts

- Higher tax on dividends IF you intend to withdraw when earning no other income or earning income below the 40% tax bracket

- Can NOT carry forward capital losses to offset against future gains

- Not eligible for annual capital gains allowance of 1,270€/year

- Have to pay taxes every 8 years whether you sell or not (deemed disposal) – you can pay this out of your fund but significantly reduces the effect of compounding and may cause you to sell assets at a loss (which you cannot carry forward).

What are the taxes?

Capital gains

Firstly some basic terminology:

Definition: The growth you make on your initial investment amount. If you buy for 10€ and in 5 years it’s worth 15€ and you sell up, you’ve made a capital gain of 5€ which you need to pay tax on. Capital gains tax (CGT) is only triggered when you SELL.

Capital gains on ETFs are taxed as “exit tax” which is currently 41%.

This is 8% HIGHER than stocks/investment trusts and you don’t get the 1270€ credit per person per year that you do with stocks and can’t carry forward losses from previous years.

Dividends

Definition: This is fixed income paid out by the fund. Different funds have different dividend payouts. This is expressed as a percentage of your investments in that fund. With stocks/investment trusts, you do not have a choice but to have these paid out from year 1, which triggers a tax event each year.

With ETF’s you can buy accumulating ETFs, which will automatically reinvest the dividends and avoid triggering a tax event until the 8th year of ownership.

Dividends on ETFs are charged as exit tax as well at 41%.

This is 11% LOWER than stocks and investment trusts while you are still working. While your marginal tax rate may be lower than 52%, your annual tax credits are already used up by your PAYE income and therefore all dividends for stocks are taxed at 52% if you’re in the higher tax bracket compared to only 41% for ETFs.

What I’m invested in

I should start by saying, the below portfolio was my very first attempt at setting up an ETF portfolio. I have since learned more about this setup and will be changing a few things, which I’ll detail below.

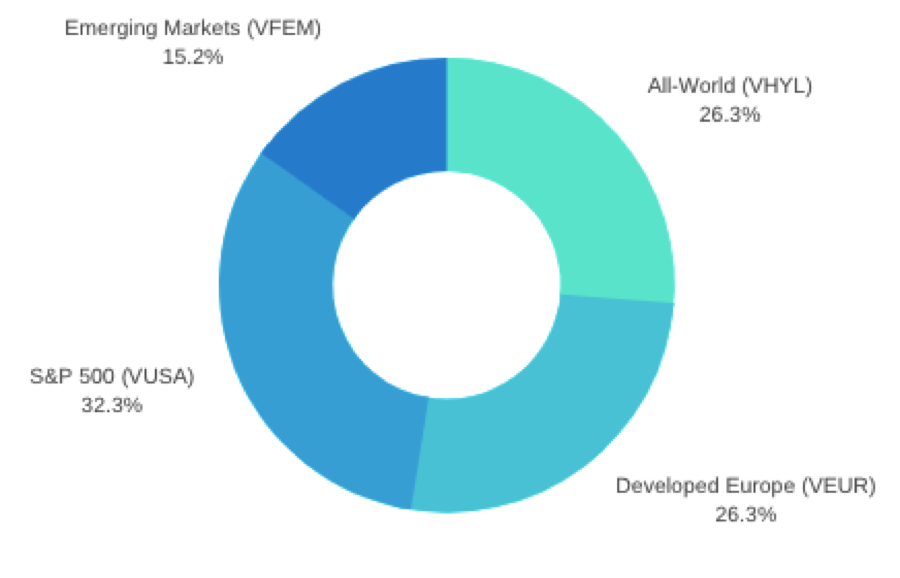

In terms of the current setup, I split my ETF portfolio into 4 main funds. This is all equities (stocks) and no bonds, so is high risk and high volatility.

I have an all world ETF, developed Europe ETF, the S&P500, and emerging markets. You can see more about each of these in the fact sheets in the links.

Fact sheets are really useful summaries to help you figure out the performance since inception, the dividend yield and the underlying asset makeup to help you make your decision.

Below are some more details on performance, fees and dividends yield of each.

You will see that the net fees weighted against this allocation are 0.16%. The weighted performance since inception of each fund is 7.14% and dividend yield is 2.32%.

| ETF names | ID | Allocation | MER (%) | Since inception | Dividend yield |

| Vanguard FTSE All-World High Dividend Yield UCITS ETF | VHYL | 25% | 0.29% | 2.07% | 3.50% |

| Vanguard FTSE Developed Europe UCITS ETF | VEUR | 26% | 0.10% | 3.86% | 2.40% |

| Vanguard S&P 500 UCITS ETF | VUSA | 32% | 0.07% | 14.70% | 1.50% |

| Vanguard FTSE Emerging Markets UCITS ETF | VFEM | 15% | 0.22% | 4.90% | 2.00% |

| Vanguard FTSE All-World UCITS | VWRL | 1% | 0.22% | 9.81% | 1.80% |

| 100% | 0.16% | 7.14% | 2.32% |

And here is it in graph form:

Things I plan on changing

I didn’t realise when I bought these that there were accumulating versions of each of these funds. What this means is that the dividends are auto reinvested and do not trigger a tax event from year 1. Instead it defers to year 8. By shifting these to accumulating funds I will increase my compounding effect as I will not be paying 41% on the dividends from year 1.

The accumulating ETFs I will be looking at are below. I had a look at the fact sheets and they are exactly the same as the distributing with the exception that one pays out dividends and the other doesn’t. Same stocks, same companies, same allocation, same fees etc.

Here is how they map out:

| Distributing | Accumulating | |

| Vanguard All-World (VWRL) | = | VWCE |

| Vanguard Developed Europe (VEUR) | = | VWCG |

| Vanguard S&P 500 (VUSA) | = | VUAA |

| Vanguard Emerging Markets (VFEM) | = | VFEA |

I will also be shifting from the high dividends all world fund to the regular one as I’m more interested in growth than fixed income (higher dividends). Typically high dividend products will result in lower gains as the companies in that fund have typically plateaued in terms of growth and incentivize shareholders with higher dividends.

You can see this difference in the two all world funds mentioned. The high dividend one has a total of 5.57% growth+dividends where the low dividend all world fund has total growth+dividends of 11.61%.

Why not all S&P500?

Looking at the yields above, why would I not want to put 100% into the S&P 500, which has been earning 16.2% since inception including dividends?

Based on various articles and investment presentations I attended, there is a belief that US markets are overvalued at the moment and unlikely to continue performing at the same rate in the long term.

As I am investing in these ETFs for the long haul, I wanted to hedge my bets by investing in more undervalued areas like Europe and emerging markets, though these are higher risk in the short term.

Why include S&P500 if afraid of overexposure to US markets?

Others have questioned, if I am wanting to reduce exposure to US markets why is the S&P500 still part of my portfolio as the all-world ETF has a lot of overlap.

Investing in JUST the all-world fund exposes me to 50% US markets. While my current portfolio make-up, including the S&P500 brings my exposure down to about 34%. The S&P500 ETF also has lower fees of 0.07% compared to 0.22% or 0.29% for the all world versions. Performance has also been higher for the S&P 500 compared to the all-world so having both gives me the diversification and lower fees and higher performance I am happier with.

How to buy

If you’re interested in adding ETFs to your investment portfolio, you can buy them yourself in online trading platforms like Degiro and Trading 212. Be sure to check the availability of the funds you are interested in as some brokers only carry certain funds.

Degiro also have a number of commission-free ETFs which you can buy one per month. Unfortunately, there is only 1 Vanguard commission-free accumulating ETFs available but you can find a number of others like iShares in this list. The ones that are accumulating usually have Acc at the end of the name. Even if you can’t find the free version of the one you want, rest assured that the savings you will make on deferring your taxes to year 8 on dividends will outweigh any fees you would incur on purchase.

When you search for the ETF you want, you may see multiple versions, some on different exchanges and even different currencies. I try to buy in Euro where possible to reduce administration when filing taxes (the currency is exchanged by the broker and does not need to be tracked by you). In terms of which exchange to buy off of (Italy or Germany), I don’t think it overly matters, the thing you need to consider is which exchange has more interest in your particular ETF, if there is less interest and fewer trades ongoing you could find it hard to find buyers of that ETF when you go to sell. I’m not entirely sure how to check this but this is the only differentiator I have come up with in trying to see which exchange to buy on.

Disclaimer: I am not a qualified investment professional or tax specialist. The views in this post are based on my own experience and should not be construed as advice. All investing comes with a risk of loss.

My experience with taxes

Dividends

So far I’ve only paid taxes on the dividends and that’s been very straightforward. You get annual tax statements from your broker and it tells you the figures you need to plug into the online form 11 on ROS.

The only place I’ve found to input this figure so far is under the foreign income tab, under line 322 a (offshore funds, payable at 41%).

You also need to enter all purchases (acquisitions) throughout the year on your form 11, but this is simply a data entry exercise, as your broker will also list all these details out for you. You also may want to keep this in mind if you are trying to buy 4 different ETFs, instead of buying 4 each month, it might be cheaper and less paperwork if you just buy 1 per month and average it out over the year.

Deemed disposal

In terms of deemed disposals, that gets a bit trickier as I think you need to calculate a first in first out method similar to when you calculate capital gains taxes for a stock portfolio where you have purchased shares on different dates.

I have not confirmed 100% yet but my understanding is that in year 8, you pay 41% on the gains you made on year 1, in year 9 you pay tax on the gains you made in year 2 and so on.

When you actually sell the ETFs, the taxes you paid in deemed disposals act as a tax credit against taxes owed on sale.

I’m working out a spreadsheet formula for this, which I will be sharing on my paid member’s area if you’d like to check that out and keep an eye on when that is added.

I’m continually adding and updating worksheets there including a time to financial independence calculator in the Irish context where you can compare investments in different vehicles, a portfolio builder, an expense tracker with auto categorization, an employee share purchase plan and capital gains tax calculator and so on.

If you like this article and would like to support the blog and more content like this, please subscribe to my member’s area for 45€/year as well as my recently launched youtube channel. Hope to see you there.

Hi Meagan,

Just one comment on “unfortunately no accumulating ETFs are available for free”, there are iShares accumulating ETFs on DeGiro’s free list. 😉

Thanks for clarifying. I don’t have access to update the article as it’s not on my site but will let WOHS know if he can make the edit 🙂

Hi you said that no accumulating funds are available without purchase fees on degiro. It’s not a vanguard fund but the ishares core msci world ucits etf is accumulating and has one free trade a month on degiro.

Thanks for clarifying. I don’t have access to update the article as it’s not on my site but will let WOHS know if he can make the edit 🙂

Hi Meagan, when you say “Unfortunately no accumulating ETFs are available for free yet…” with regards to Degiro’s free-fee ETFs, are you sure? I own the iShares Core MSCI World UCITS ETF (IE00B4L5Y983), which appears on the free-fee list, and I believe it’s accumulating.

Thanks Ulick for clarifying. You are right though I don’t have access to update the article as it’s not on my site but will let WOHS know if he can make the edit 🙂

Hi Meagan,

Thanks for your informative blog and for your work.

Would mention here other ways to invest in ETFs. Pension schemes. Even though I know that you don’t like them for various reasons.

However, some ETFs are available through pension funds. PRSA come also with some taxes (Management fees etc), but there are ways to minimize them: passive funds (no fees to the agent), rather than active funds; with a bit of research, there are funds with around 2 percent tax/per year; there is no other tax on funds growth; of course, taxation on retirement, but there are ways to minimize them, legally.

Personally, I have a pension scheme where employer contributes to my pension too. I invested in 2 indexes – technology (S&P 500, but only IT) and North American Equity Index Fund. Funds can be withdrawn starting with age 55, provided I’m not in service anymore. It’s a good option, especially with the tax relief at the moment.