This post goes into how to file taxes for ETFs in Ireland. I’ve been getting a few questions on how to file taxes on ETFs so thought I’d do up a post. I am not a tax specialist and this is based on my own experience.

If you have any non-PAYE income in Ireland you will need to get used to filing taxes each year. This can seem daunting at first but once you take the time to do it once, it becomes much easier the second year AND you save accountancy fees.

Table of Contents

Step 1: Determine if you need to sign up for ROS

PAYE earners

From Revenue guidance, it seems you should be able to report non-PAYE additional income through MyAccount under Review Your Tax -> Income tax return.

You should only need to file a form 11 through ROS if you have a taxable non-PAYE income of 5,000€ or more.

Another reader mentioned their experience was that there was no set place to enter ETF income on the MyAccount filing. They were told by Revenue to calculate what was owed, make a payment and then submit a note to let them know what the payment was for. Read step 2-3 for more info on when taxes are due and where to get your base figures.

For dividends simply multiply the dividends paid out in a given year by .41 to get the exit taxes due on them. This is the amount you’ll pay to Revenue.

For gains and deemed disposals see sections below for more details as these get a bit trickier and need some additional calculations. I’ve made a calculator available for these in my member’s area if you are selling ETFs and need to calculate what to pay revenue.

Self assessed/Form 11

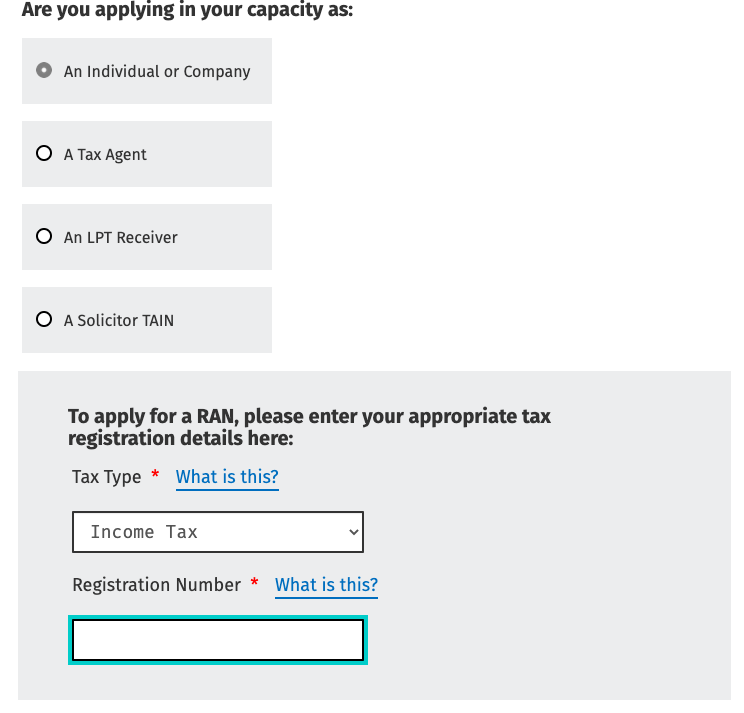

If you are not already registered for Income tax you may need to login to your MyAccount first and go to Tax Registrations in the Manage my Record section.

Once you are registered for Income tax then you need to sign up for a ROS account.

Apply for your ROS access number, select individual, income tax and enter your PPS number.

The help text on Revenue is a bit confusing where it says if you have PAYE and LPT only, then you should sign up for MyAccount instead. If you have any non-PAYE income from any investments (rental income, rent a room scheme, stocks, ETFs etc), you will need a ROS account to file your non PAYE taxes annually.

When the sign up form asks for your registered tax number this will be your PPS number.

Enter your contact details on the next page and wait for your RAN in the post. Once received you can complete the process of setting up your ROS account by setting up your digital certificate on your personal computer. You will only be able to login to ROS from the computer you have this certificate installed on.

Step 2: Know when taxes are due

You need to file taxes for ETFs when:

- You buy ETFs (no taxes due, just need to inform Revenue of the purchase)

- You receive dividends from your ETFs (taxes due)

- You have owned your ETFs for 8 years (taxes due as deemed disposal)

- You sell your ETFs (taxes MAY be due if you had a gain, losses or nil payments also must be filed, you also can claim back a credit for any deemed disposals you have paid at this time)

Taxes on ETFs must be PAID (if taxes due) and FILED by October 31st, the year following the event (as per list above)

Step 3: Download tax documents from brokerage

In January/February, your broker should have some annual tax reports breaking down all the details you require for filing your return. Degiro includes your gains and dividends broken down by source and also all transactions from the year.

For example:

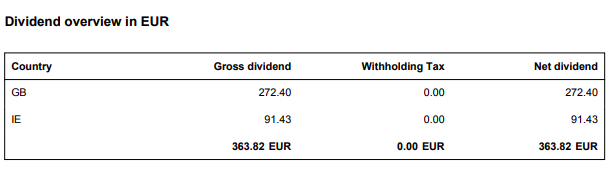

Dividends

This is how dividends are listed in Degiro’s annual tax report.

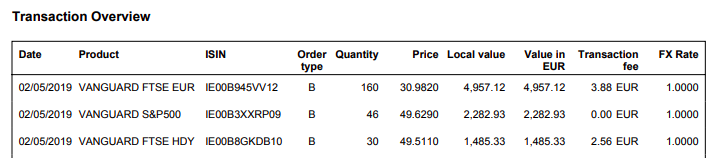

Purchases

This is how purchases are listed in Degiro’s annual tax report. This shows all the information you need to file your tax return and track your purchase price and costs for exit tax calculations when you actually sell or need to file deemed disposals.

Step 4: Enter the information into ROS

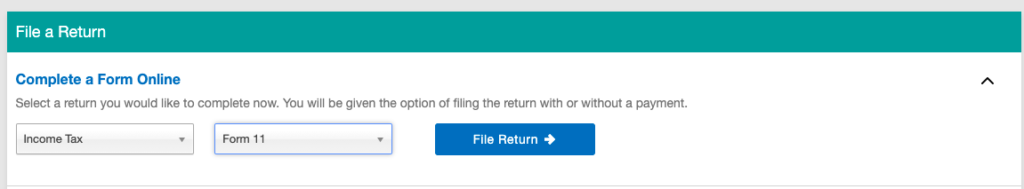

Log into your ROS account and go to File a return -> Income Tax -> Form 11/Form 12 -> File a return

Complete the information on the next few screens until you open up your Form 11/Form 12

You need to complete the Personal Details tab before you can access any of the other tabs. Once complete, if you only have ETFs to file, you can go straight to the Foreign Income tab.

When trying to find where to input information it’s very useful to refer to the paper/PDF form and guide from revenue. I click on control+F to bring up the search function in the browser and search for specific terms I am looking for help with. This helped me to find where to input the information.

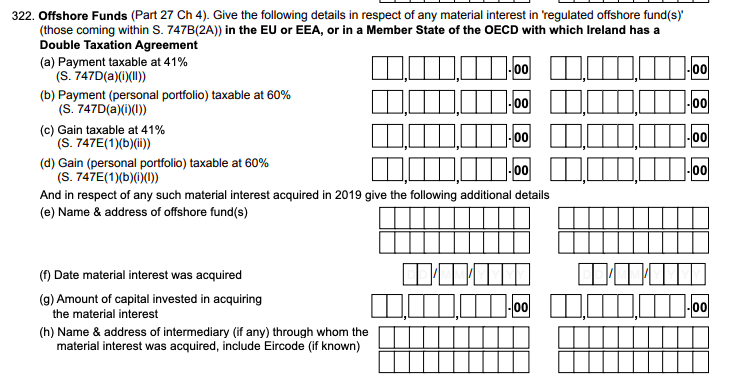

The only place I could find to enter details with a 41% tax rate was under Foreign Income Offshore Funds.

The online form doesn’t have the numbering on the form but you can find the equivalent space to input this information.

Purchases

I filed purchases under section 322 (e), (f), (g) and (h), in the online form you can add more than one.

You need to log EVERY purchase of ETFs through the year on your tax return so this may influence your purchase strategy. If you want a portfolio of 4 ETFs and you purchase 4 ETFs each month, you will have 48 entries to make. The better approach might be to purchase 1 ETF each month, spreading your 4 ETFs over the year, limiting your purchases to 12. This also reduces purchase costs as Degiro charges a flat fee of 2€/ETF trade saving you 72€ in trade fees/year.

Dividends

If you have distributing ETFs that pay dividends out, you can get the figure from your broker tax report and input it in 322(a)

If you have accumulating ETFs, I believe the taxes on these get paid out on sale or deemed disposal only (whichever comes first).

Gains

If you have sold ETFs with a gain (where the difference between your sale price and purchase price is above zero), you input the gain in 322 (c).

This makes it more like a data entry exercise as ROS does all the calculations for you.

Deemed Disposal

I haven’t had to do this yet myself and do not have a definite answer on how it works but here is my understanding.

- In year 1 you buy an ETF, in October of year 9 you file and pay taxes on any gains on the purchases you made in year 1 (as per their value in year 8)

- In year 2 you buy an ETF, in October of year 10 you file and pay taxes on any gains on the purchases made in year 2 (as per their value in year 9)

- Every year after year 8 requires filing and paying deemed disposal in a laddered first in first out (FIFO) approach.

Example:

- You buy an ETF in 2020 worth 100€, in 2028 it is worth 200€

- By October of 2029, you need to file and pay the taxes due as if you had sold the ETF you bought in 2020 (deemed disposal).

- 200€-100€ =100€* 41% = 41€ due

- In 2021 you bought another ETF worth 120€, in 2029 it’s worth 220€

- By October of 2030, you need to file and pay the taxes due as if you had sold the ETF you bought in 2021 (deemed disposal).

- 220€-120€=100€ *41% = 41€ due

- In 2031 you ACTUALLY sell the ETFs you bought in 2020 and 2021, they are now worth 205€ and 225€

- Your ACTUAL gain is:

- sale (205+225=430) – purchase (100+120=220) * 41% = 86.10€ – deemed disposals already paid (82€) = 4.10€ due.

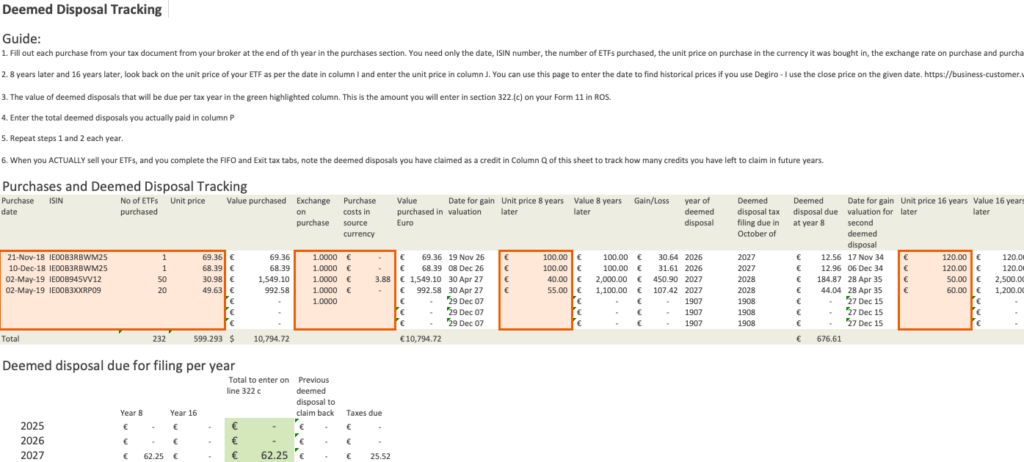

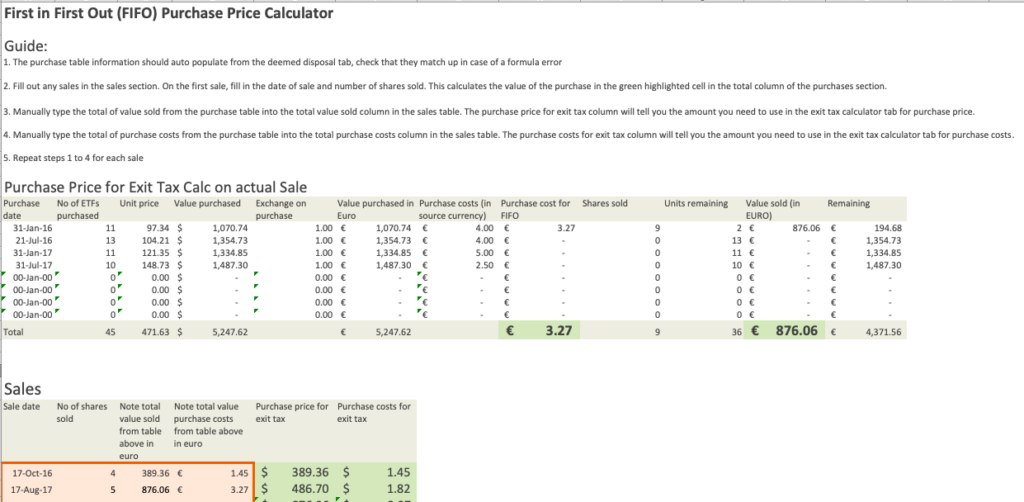

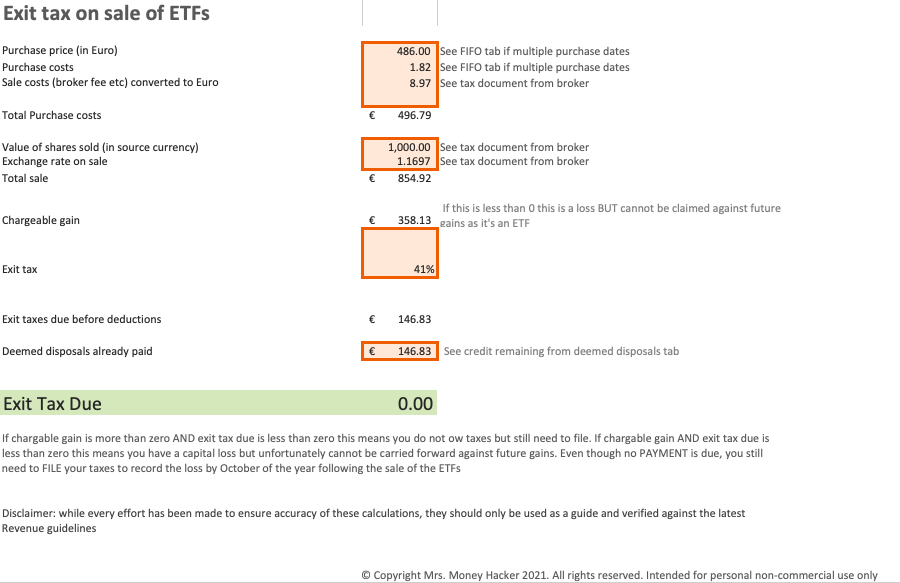

If you’re buying and selling on different dates, I think ETFs work the same as stocks in that they operate on a first in first out basis (FIFO), and in this case, you’d need to keep track of all of these purchases and sales in a spreadsheet. I have developed a tracker for this which is available in my paid member’s area. The subscription cost will more than cover the cost of your time should you want to build this calculator yourself (trust me).

This spreadsheet helps to track deemed disposals as well as calculate exit taxes due on actual sale using the FIFO method, taking into account any deemed disposals you can use as a credit.

Screenshots below.

Note: ETFs purchased through financial advisors are called Unit linked funds and their deemed disposal works differently under what is called a gross roll up scheme, in that in Year 9, you pay taxes on ALL the gains you made from year 1-8. In year 16 you pay taxes on ALL gains you made from year 9-16. I have not found a definitive answer as to how ETFs bought as an individual investor are taxed but from all my digging I think my first example is correct, though happy to be corrected. I must get around to emailing Revenue on it to get a clear answer.

Step 5: File your return and make payment

Final steps for submitting the return and making the payment can be found here.

I hope this demystifies some of the administration and tax filing questions some of you may have had. I certainly had to dig through online forums to find some of these answers as it is not clearly defined on Revenue’s guides.

Screenshots of Deemed Disposal Tacker

And here are some screenshots of my deemed disposal tracker available on my paid member’s area.

Deemed Disposal Tracker Tab

First In First Out Purchase Price for Exit Tax Calculations Tab

Exit tax calculator on sale of ETFs Tab

Another fantasic post

You should post this in http://www.reddit.com/r/irishpersonalfinance

You get mentioned in there quite a bit 🙂

Thank you

Many thanks Alan, I’ve posted in there now 🙂

Great Post Meagan, you really detailed to whole process.

I just have question on deemed disposal. lets say you bought 1 ETF every month up until year 8. in that case are you only paying tax on those first 11 or 12 purchases in year 8 assuming you didn’t sell anything. i always assumed you pay 41% on all gains from first purchase date to time of deemed disposal.

Hi Des, I haven’t been able to get a definitive answer on this but what you are describing is how a unit-linked fund under a gross roll-up scheme would be taxed. But this is through a collective group investment vehicle and my understanding is it’s different for retail investors (from what I’ve read on forums, I have not gotten a definitive answer from Revenue as yet). My understanding is it’s a laddered approach in that everything you bought in year 1, you calculate what it is worth in year 8 and you pay taxes on the “gains” from the ETFs you bought in year 1 by October of year 9. In year 9, you calculate the gains to date on all ETFs you bought in year 2 and you make the payment in October of year 10. And so on. I made a worksheet available on my member’s area to help keep track of this a bit better if you’d consider signing up :).

Great! I’ve learned a lot again!

Btw, about when you have to use ROS, there’s another condition: If your gross non-PAYE income is above 30k (It can happen if you do Short-term letting and have many tax deductions). Check out a piece of conversation I had with Revenue via MyEnquiries in 2019:

”

(…)

You do not need to register for self-assessment if:

1. you only have PAYE income

or

2. your taxable non-PAYE income does not exceed €5,000 and your gross non-PAYE income does not exceed €30,000.

(…)

“

For the deemed disposal part, the ETF guidance note says “The tax treatment of investments in Irish Domiciled ETFs and ETFs domiciled in EU countries other than Ireland follows precisely the treatment set out in Chapter 1A of Part 27 TCA 1997 for investments in Investment Undertakings (IUs) – see Tax and Duty Manual (TDM) 27-01A-02.” Ch1 is the document about the 8 year deemed disposal of unit funds.

Given how many contradictions exist from Revenue on the matter I’ve recently queried it with a simple but not gotten a response yet (7 weeks and counting). If I go with the yearly method, I pay less tax this year and could be said to under pay tax. If I go with the 8 year roll up method, I pay more tax this year, but less tax overall. Both cases would still be above the 41% rate due to losses though.

Personally if Revenue want to treat ETFs individually then they can’t turn around and also impose FIFO rules as that, by definition means a grouped investment.

We can only hope they clear this stuff up when the release the newer guidance note.

Thanks Stephen, It seems their ETF guide is under review so hopefully we will get some clarity soon!

While trying to register for Income tax on MyAccount, I was asked the NACE code, what sort of business I’m going to run, and what would be the expected turnover, it really confused me and made me wondering if I was doing the right thing.

Hi Alan, It’s hard for me to say, I can’t remember being asked that when I signed up on ROS. A quick call to Revenue might help guide you better for your particular situation?

Alan, I am in the same situation. Let me know if you have an answer.

Hi Alan and everyone else,

The NACE code is 9803, according to a reply from Revenue to me.

Personally, I state the “business” as “Investment in UCITS ETFs”.

Hi. Good post. Just on the section about notifying each purchase to the Revenue. You don’t need to do that for Irish domiciled ETFs (which I think you are increasing in). I asked them directly on MyAccount and they said “Based on the information you have supplied [that I buy only Irish ETFs] it is our view that the acquisition of Irish Domiciled ETFs does not have to be notified to Revenue.” You’ll save yourself loads of grief. Cheers.

Nice one, thanks I’ll update the post at some stage.

Hi Meagan, thanks for a great post. I am aiming to invest in accumulating ETFs in the next few weeks and hold for multiple years and so won’t have any gains to report. I am a little confused on timing of reporting. When do I have to declare 2021 purchases with Revenue? Is it on an ongoing basis or in October 2021 or in October 2022. Any help much appreciated.

HI Eanna, Thanks for reaching out. Another reader just mentioned that they contacted revenue and found that you do not need to report acquisitions of Irish ETFs so seems like that’s not needed. Just need to report deemed disposals or exit taxes on sale or receipt of dividends (for non-accumulating ETFs). In the past I reported my acquisitions for 2019 when I filed my return in Oct 2020.

Thanks very much Meagan for your really helpful reply! I think I will be sticking with the Irish domiciled ETFs!

Hi Meagan, I am trying to file my return for 2021 ahead of the deadline on the 31st. I am a PAYE employee so am able to do it through “myaccount”. Looking at the web link where I am filling it in I can see it includes “form12-2021-web” so I appear to be in the correct spot. I am trying to declare purchases of my ETFs, no sales. The options look to be either “Foreign Non-Deposit Int/Annuit/Royalt/Divs” or “Other Foreign Income Including Rents”. When I go into either it won’t let me put zero in as the income (I have no income as I just bought the ETFs in 2021 and didn’t sell). In addition, I only seem to be able to enter one record. It’s very confusing. All I want to do is declare that I bought them. It should be straightforward but clearly isn’t.

Any help would be appreciated!

Or do I need to submit a form11. I am very confused I must say! Any guidance would be appreciated. And if so am I a bit late ahead of the 31st setting up a ROS account if something has to be posted to me?

Hi Eanna, Another reader said they contacted Revenue re: reporting purchases of ETFs and were told “Based on the information you have supplied [that they buy only Irish ETFs] it is our view that the acquisition of Irish Domiciled ETFs does not have to be notified to Revenue.” – so seems like that is not required, but might be best to write them directly to have it on record for your own situation.

Can we deduct the Personal Exemption of 1,270 from the gains when selling the ETFs?

Hi Bruno, Unfortunately, gains on ETFs are treated under exit tax and not subject to CGT and therefore not eligible for the annual CGT exemption, as far as I know

Hey Meagan, thanks very much!

I notice the link under step 5 is broken. You may want to fix it.

I have another questions, if you don’t mind 🙂

– Which option do you use to make the payment at the ROS website? I can see three potential candidates, but not sure which one is the correct (if I had to bet, I would chose (a), but I’ would like to double-check with you):

a) Submit a Payment > Foreign Income and Assets Disclosure.

b) Submit a Payment > Tax Payment/Declaration > Income Tax.

c) Submit a Payment > Tax Payment/Declaration > Capital Gains Tax.

Thanks Bruno, I’ve updated that link now. If you follow the guide here it says to select income tax for form 11 https://www.revenue.ie/en/online-services/support/documents/ros-help/submitting-form-11-online.pdf – As the deemed disposal is part of the form 11 I think this makes sense.

Hi Meagan,

Thank you for the very informative post.

I read on a forum (ask about money) that losses even within the same ETF can not be offset against tax.

So the following scenario is possible:

I purchase shares in the Vanguard All World ETF:

Jan – Buy €100 Worth €150

April – Buy €200 Worth €150

Total Cost =€300

Total Value =€300

While you might assume no tax is payable actually April is forgotten about by revenue and referred to as a “nil gain”.

The €50 gain in Jan is taxed at 41%.

A scenario where the figures are increased, say where a person is dollar/euro cost averaging a lump sum into an ETF, could leave a person with a pretty nasty tax bill even for a fund that’s in modest profit or worse paying tax for a loss making year.

Is this information correct?

I hope not but the poster on ask about money did quote a response from revenue.

Hi Jimmy, I don’t think that’s correct. Firstly, you only realise losses or gains when you actually sell or upon deemed disposal on every 8th anniversary of owning the ETF. The only taxes due on ETFs from year 1 are the 41% on dividends if you’re in a distributing ETF. If you are in accumulating ETFs you’ve no taxes due until you actually sell or for deemed disposals. It is true that losses cannot be carried forward for ETFs unfortunately but when you calculate your gains on sale it’s using the first in first out method as far as I know so in your scenario, say in year 2 you sold 150€ of ETFs, you would owe the taxes on the 50 euro gain you made on the ETFs bought in Jan as those are the ones you bought first. Then the next year you sell the other 150, you would not owe any taxes but you also could not “bank” the loss to be used as a credit against future gains. If on the other hand you sold all shares in year 2, you would not owe any taxes. I have a deemed disposal/exit tax calculator in my member’s area where you can play around with these scenarios to get a better understanding. I of course am not a tax specialist but this is my understanding.

Thank you very much for the prompt reply. Yes i thought the scenario i quoted was particularly punitive in what is already a punishing tax system with deemed disposal.

Thank you for taking the time to clear that up.

Im really enjoying the blog and its a source of very good information. Keep up the good work.

Awesome post. A question about when you declare the purchases. What do you put in name/address of the offshore fund, is it the name of the ETF, and broker’s address?

HI Luke, Thanks for reading. I just put in the name of the ETF

In case I have only PAYE income but I am filling form 11 to declare ETFs I have purchase during the tax year, do I have to pay any preliminary tax?

Hi Michele, As far as I know, preliminary tax only applies if you need to do a self-assessment tax return. Generally, if you are PAYE only and have taxes due from other sources (investments) that amount to less than 5,000€ (where the gross non-PAYE income does not exceed 30k before tax deductions), then you don’t need to self-assess. More criteria are listed here: https://www.revenue.ie/en/self-assessment-and-self-employment/guide-to-self-assessment/register-it-self-assessment.aspx. When in doubt though, reach out directly to Revenue and they will confirm.

As far as I understand, preliminary tax applies to chargeable persons, i.e. those who need to file Form 11.

ETFs can only be filed on Form 11 and will go towards your net Income Tax calculations, affecting final tax liability.

So yes you will have to pay preliminary tax, but that’s based off of your final liability. Your PAYE income tax will be deduced from final liability, leaving only ETF gains / dividends if that’s the only non-PAYE source you have.

So, in effect, you’ll be paying preliminary tax on any realized ETF gains / dividends.

Hi,

I just wanted to get some clarity, as two people have noted contradictory explanations of whether you need to self-assess and file Form 11 if you earn less than €5,000from non-PAYE income.

On the one hand, it has been mentioned here that you do not need to sign up for self-assessment through ROS if your income from ETFs is less than €5,000. But on the other hand, a user has mentioned that the only way of declaring ETFs is through Form F11 as a chargeable person.

I started buying ETFs at the start of 2025, but decided that I would rather have a more hands-off approach going forward, so I decided to sell all of my ETFs in 2025, with a small gain.

Say, for example, I have bought European ETFs and sold within 2025 with gains less than €5,000. In this case, should I file Form 12 on myAccount, or do I need to pay Preliminary Tax this year, and create a ROS account and file Form 11 next year to include my ETF purchases and gains?

I have contacted Revenue about this and will post my response from here for others when I hear back.

Hi Loui,

I am just reading this comment and am in a similar situation. I am wondering if revenue replied to you on this yet?