Want access to all of Mrs. Money Hacker’s spreadsheet templates?

By signing up you gain access to all the latest spreadsheets which have taken hundreds of hours to create and fine-tune over the last number of years.

These spreadsheets formed the basis of my personal consultations and analysis for which clients paid up to 450€ to complete. As my mission for this blog is to help as many people as possible, and my time is limited, I wanted to make these available to a broader audience at a more accessible price.

Instead of a once-off static spreadsheet, having an annual recurring fee means you get access to periodic updates when things like tax credits and rates change. All spreadsheets have been reviewed and updated where required as of Dec 2023.

Already a member?

What do I get for signing up?

Spreadsheets include:

- General Finance

- Expense tracker

- Car Cost calculator

- Investment worksheets

- Time to Financial Independence calculator including a portfolio tracker, investment property worksheet, net worth tracker and income tax calculator

- How Much Can I Invest calculator

- Portfolio Builder

- Investment Property Yield worksheet

- Tax calculators

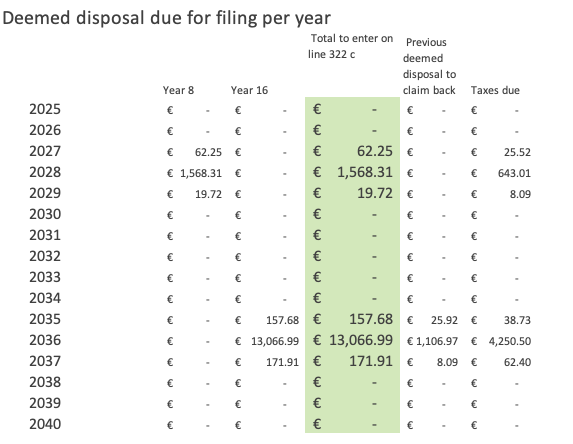

- ETF deemed disposal tracker and exit tax calculator using first in first out (FIFO)

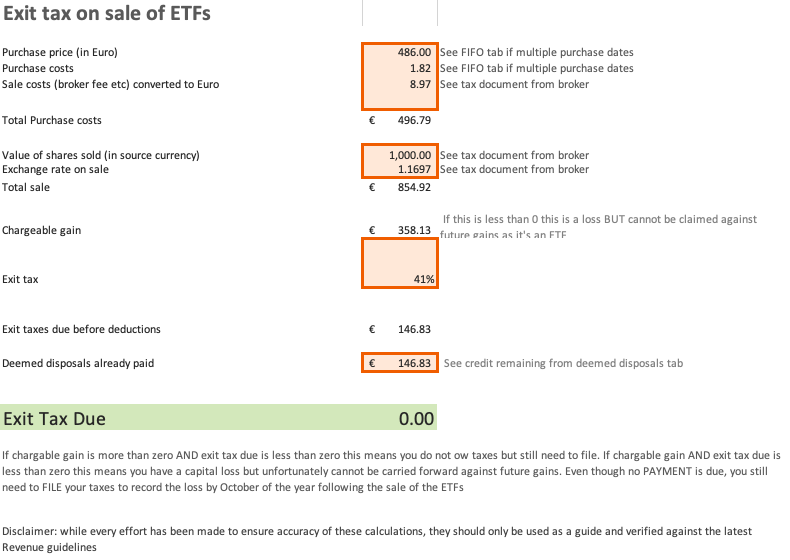

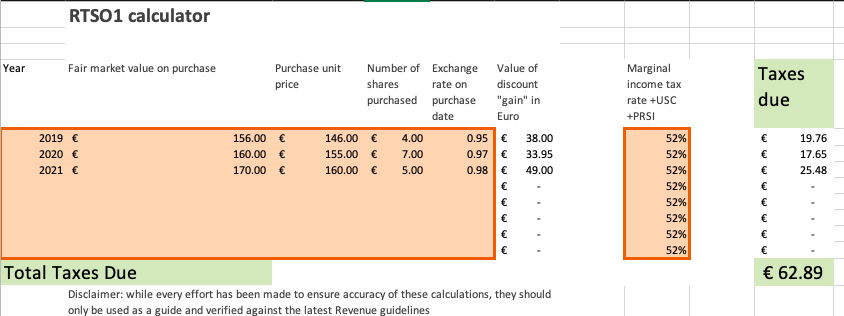

- Employer Share Purchase Plan (ESPP) and regular share tax calculator including FIFO, Capital Gains Tax (CGT) and RTSO1 tax form prep

Screenshots of some of the worksheets below:

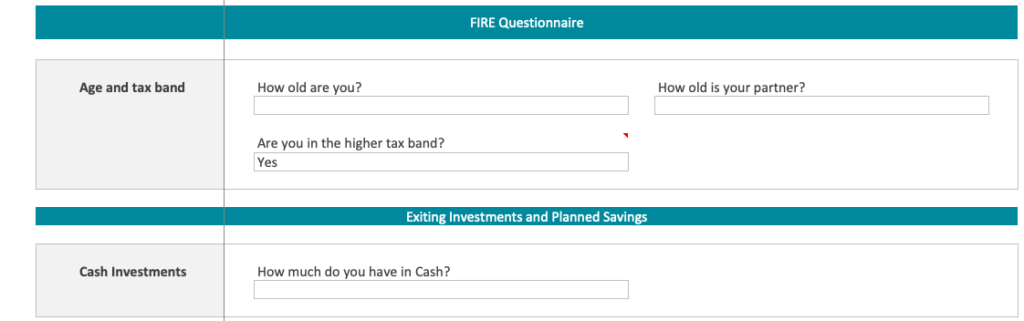

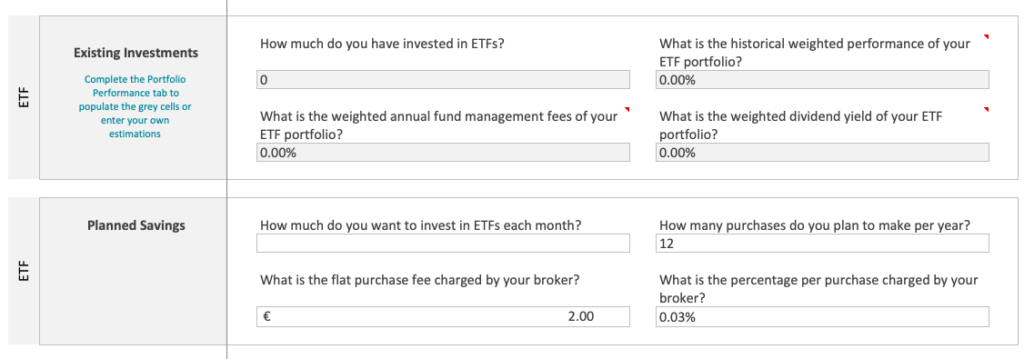

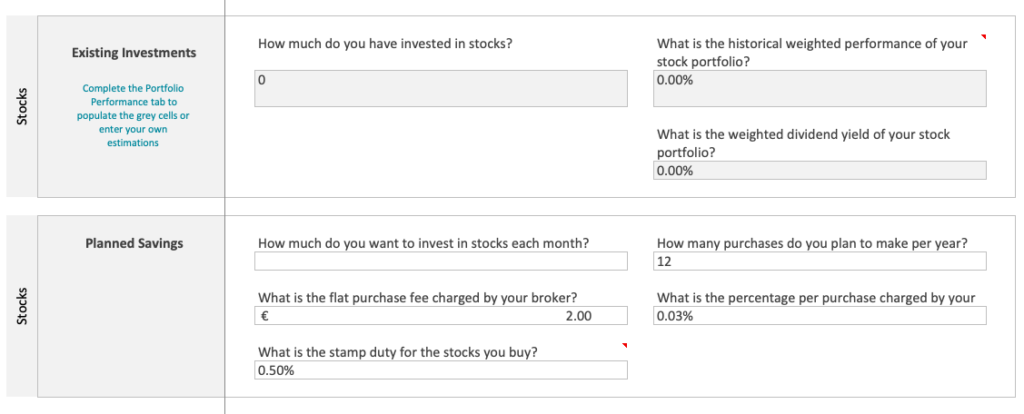

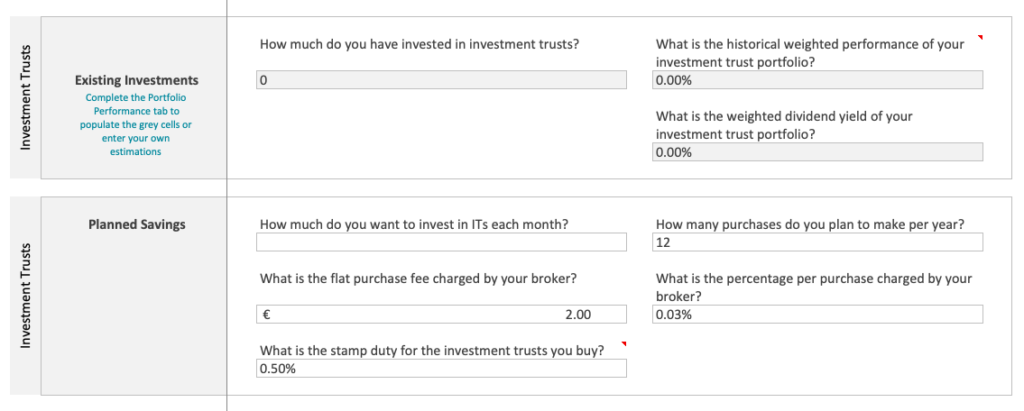

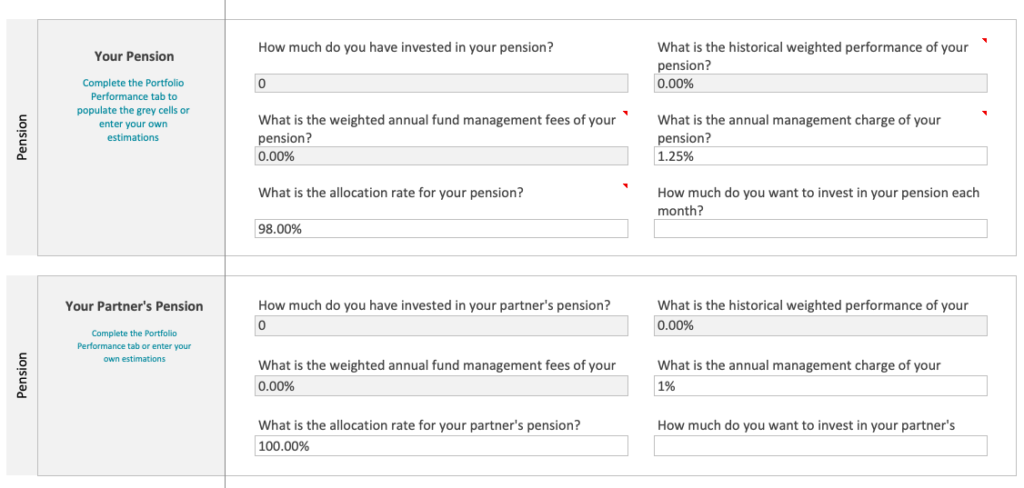

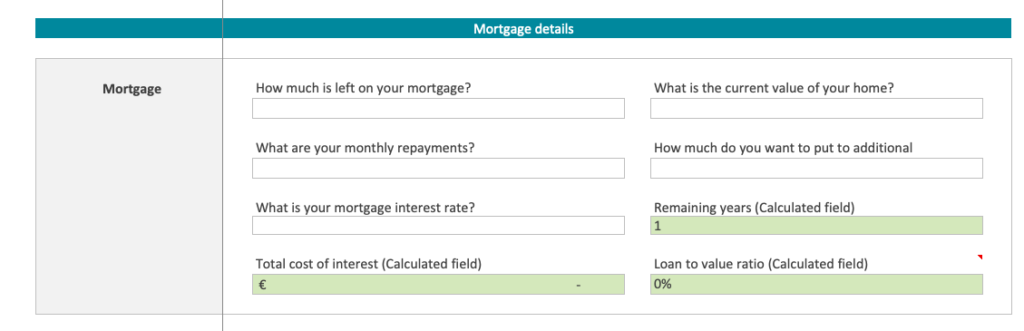

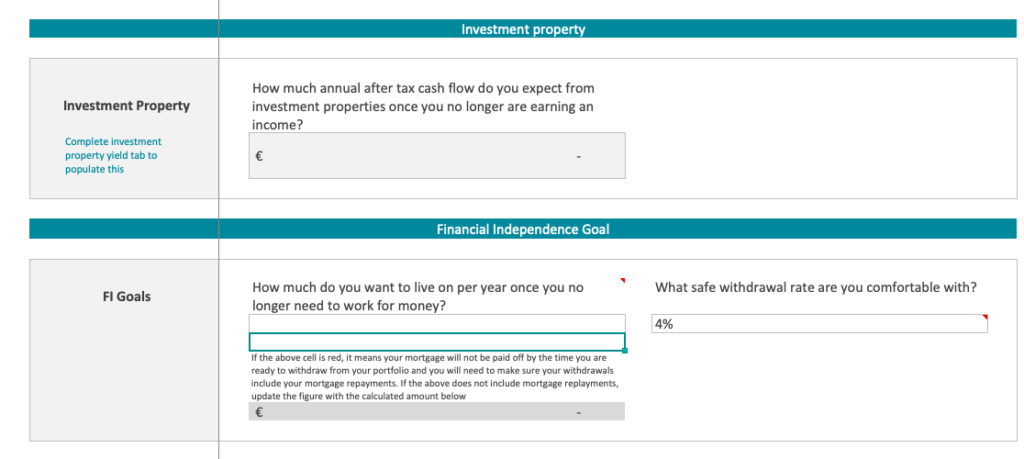

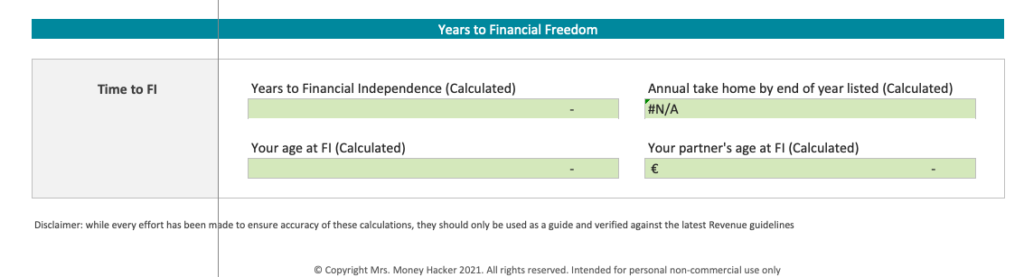

Financial Independence Calculator

Note: This is specific to the Irish market in terms of taxes but all formulas are editable to easily update for your country-specific taxation.

Simply fill out the questionnaire and see the impacts automatically translated into how many years your changes will cut off your time to financial independence. Also includes a mortgage calculator to show the impact of additional lump sums in terms of interest savings and reduction in years.

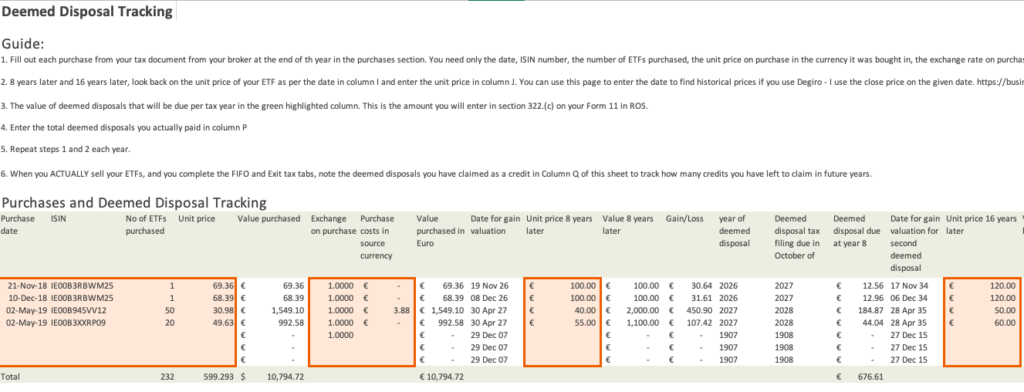

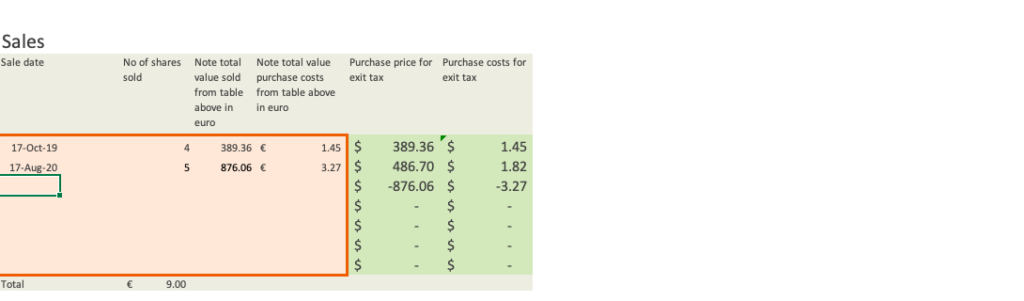

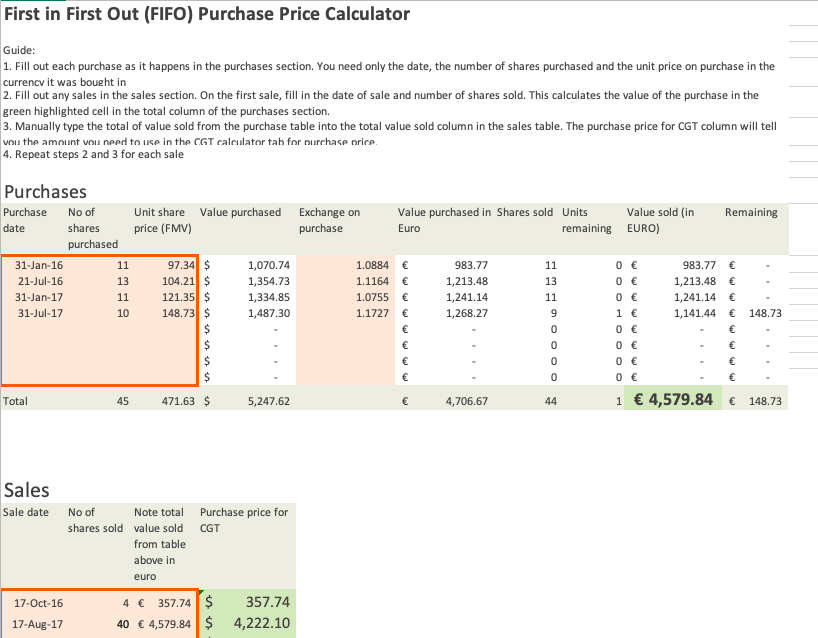

Deemed Disposal Calculator

Stock/Shares/ESPP, RTSO1 and CGT Calculator using FIFO

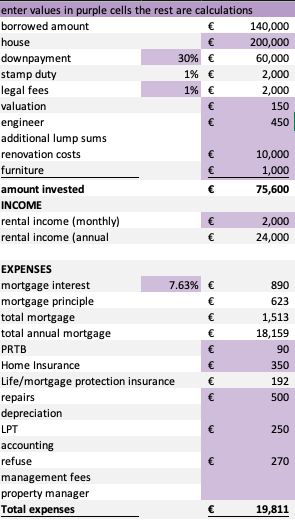

Investment Property Worksheet

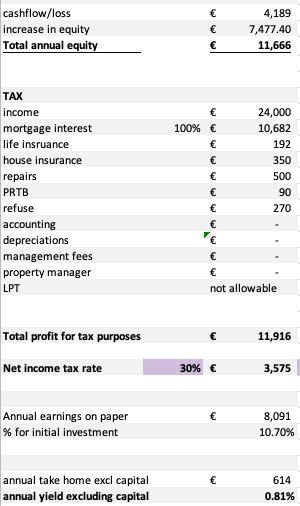

How much can I invest calculator

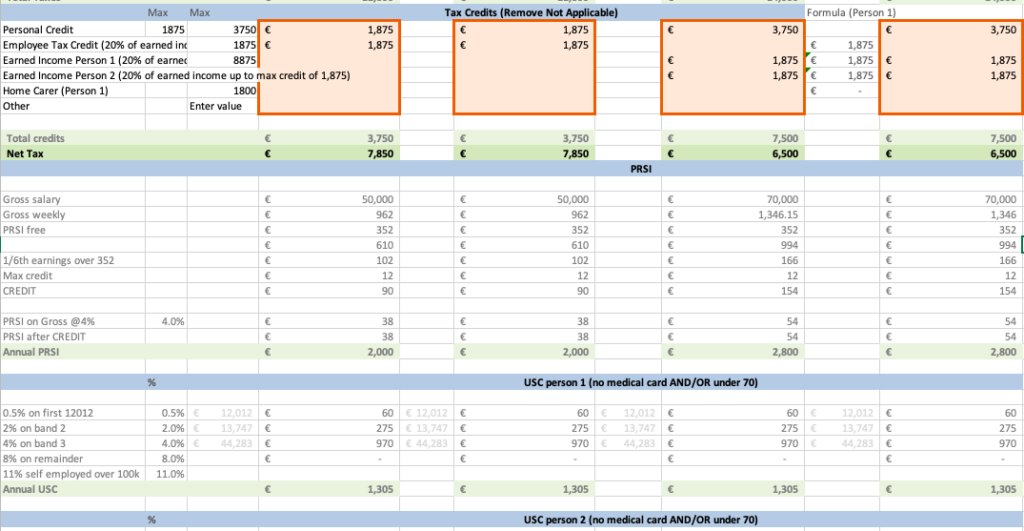

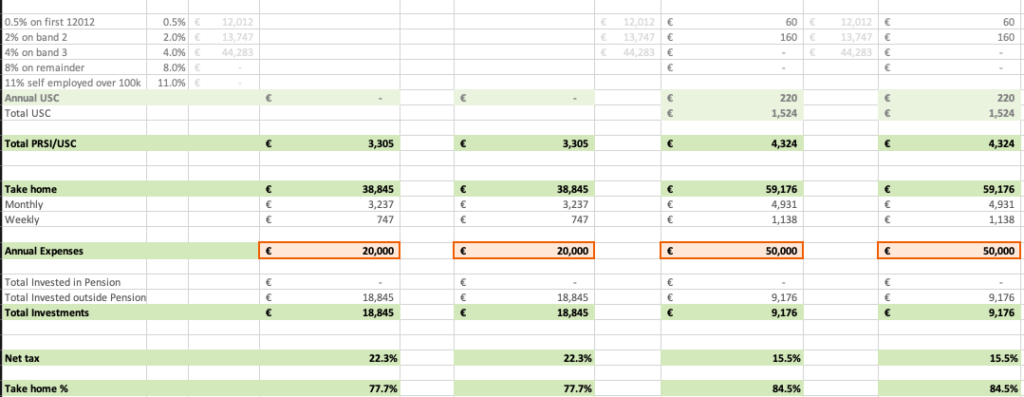

This calculator helps you figure out how much you can invest by taking your personal salary, pension contributions including employer matching, taxes, tax credits, and annual household expenses into account. Again, these are specific to Irish taxes but all formulas are accessible to apply your own countries tax rates.

This worksheet also shows you your net take-home percentage and amount per year, month and week as well as your net rate of tax once all credits have been applied. This is handy if you are considering certain life changes which impact your finances.

Updated with 2024 tax credits.

For example:

Consider a promotion: If you are offered a promotion and weighing the additional responsibilities against the actual take home after taxes, this calculator can help you decide.

Going down to one income: If you’re considering going down to one income and qualify for additional tax credits, this can also help you see the net tax impact on your income.

Increasing your pension contributions: Considering upping your pension contributions but want to see the impact on your take-home? Simply enter your details and see how much you can increase by before you can no longer cover your annual expenses after taxes.

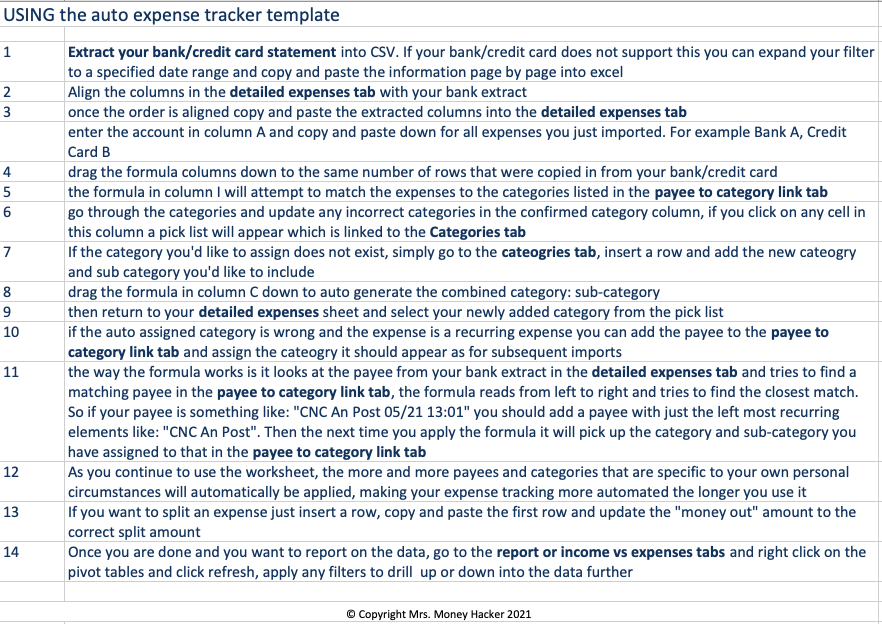

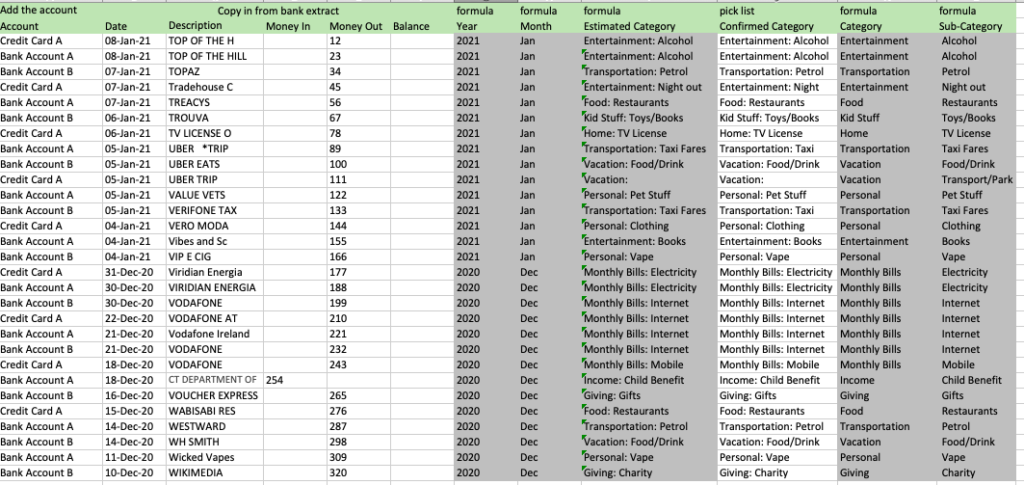

Expense tracker

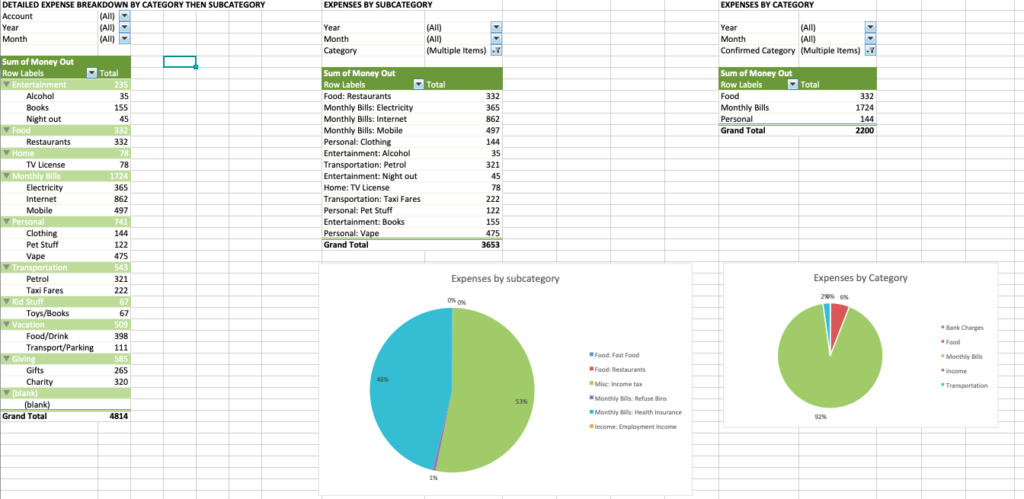

The very first step to setting any financial goals is taking stock of where you are. This means getting a detailed picture of where your money is currently going. Without knowing where you are, you cannot begin to plot a route to another destination. This expense tracker should help by enabling you to extract or copy and paste your expenses from your bank and credit cards into this spreadsheet and over time, the formulas will automatically categories your expenses by the categories you set. I have made a best effort of a decent foundation by including all of my own personal expense categories from the last 6 years here in Ireland. Once you have the information in one place, you can roll up reports into summary tables and charts to help you get a better picture of where you might stand to cut back.

User Guide

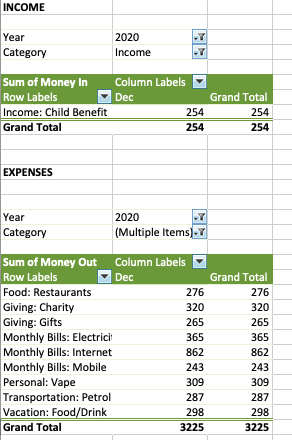

Summary Reports

Income vs Expenses

Detailed expenses as per bank and credit card extracts

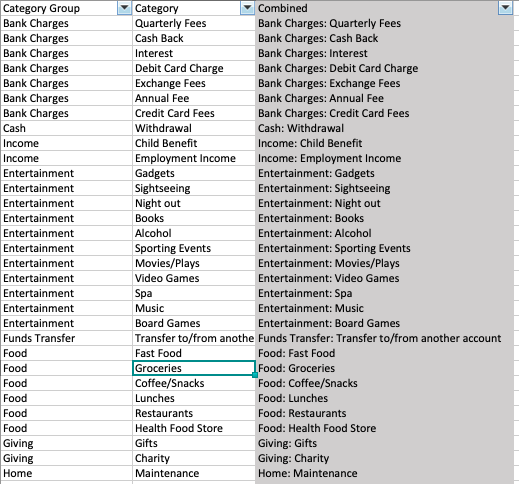

Category and Sub Category Settings

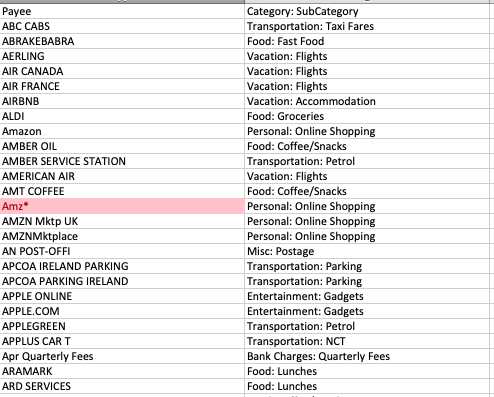

Category per Payee (for auto categorisation)