As I mentioned in my last post, the Money Hacker family moved from Ireland to Canada in June 2023. At that time we had assets in both Canada and Ireland. This post will go through how we decided to centralise and invest our money in Canada and what we invested in.

Asset shift

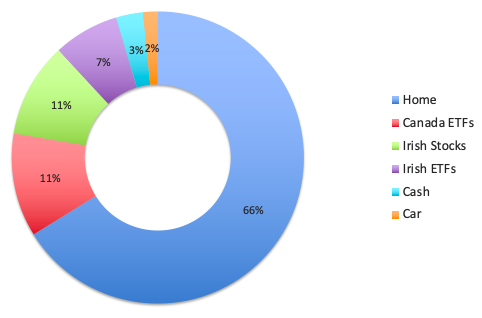

Before we moved back, our assets were split per the below chart:

Our home made up the majority of our equity (66%), then our Canada ETFs and Irish stocks (Mr. MH’s old work scheme) made up 11% each and our Irish ETF portfolio made up 7%. We kept a cash buffer to cover a few months of living expenses, making up 3% and our car made up 2%.

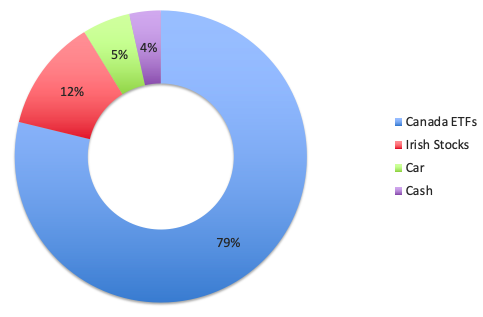

For now, our new asset breakdown looks like this:

79% of our equity is now made up of our Canadian ETF portfolio. 12% remains in our Irish stock account which we will start to sell off when we start to withdraw from the portfolio. 5% is the value of our car and 4% remains in cash as an emergency fund.

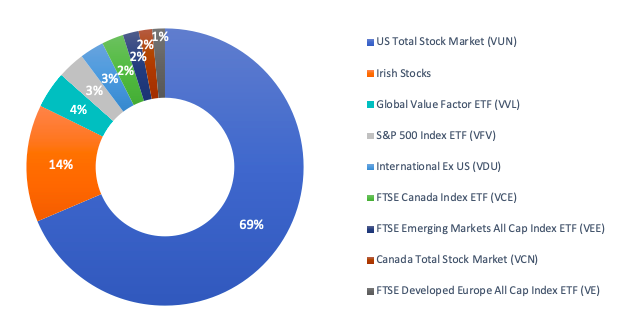

In terms of existing assets, I wasn’t going to sell them off and trigger a tax event unnecessarily so for now our portfolio will look a bit more complicated than it needs to be. Eventually, as we start to sell off funds when we start to withdraw, we will sell off the funds we no longer want to hold first and our portfolio will get simpler over time.

Detailed Canadian ETF Breakdown

Once we moved, we had to decide how to restructure our assets. I didn’t want to have assets in 2 countries as I didn’t want to have to keep filing taxes in both as well as to continue managing multiple investment accounts and portfolios. I’m a big fan of the keep-it-simple approach.

As mentioned in my last post, we decided we would rent instead of buy a new home for the time being and so we wouldn’t be needing any large sums any time soon and even if we do want to buy again, we’ve decided we’d like to save up and start again, leaving the rest of our assets invested to grow.

To start building out our new portfolio, I did up a budget, figuring out how much cash we would need to cover the next twelve months including the purchase of a new car and other setup costs. I also figured we needed to leave some cash in our Irish account as we had plans to travel to France, Portugal and Ireland within the next twelve months and there was no point converting the cash only to convert it back again a few months later. Once I knew how much we needed to leave out, we took the money from the sale of our Irish home, sold our Irish ETFs and moved the money to Canada. From there I took the opportunity to apply the knowledge I’ve acquired in investing so far and made up a new consolidated ETF portfolio.

Initially, I was just going to continue replicating the ETF portfolio I already had. It has performed well enough and has good diversification, but when it came to investing the largest sum of money I will probably ever invest at one time, I thought about all the other long-time FIRE bloggers that I follow. All of the American bloggers have said time and time again to just invest in VTSAX (Vanguard Total US Stock Market Fund) and block out the noise about anything else. J L Collins says he plans to never sell and just live off the dividends.

The bloggers I follow worked to reach their full FIRE number before retiring early but have way more now than they will ever need, partly because they never really stopped working. They just work how and when they want to work now, on things that they are passionate about. Working for money is optional for them but if you have the drive to reach FIRE, you are not going to be the kind of person to sit back and never earn money again. Looking at my investment portfolio and own journey to FIRE in this light gave me new perspective. I decided I would follow suit and take a bit more risk than I previously would have by investing in one ETF with exposure ONLY to the US stock market.

Consideration 1: VTSAX is not available in Canada. After some research, I found a very similar fund. This post gives a good comparison. In summary, if you buy VUN (Vanguard Total US Stock Market ETF), it’s made up of the same underlying stocks as VTSAX but it is purchased in Canadian Dollar. Unfortunately, the annual management fee is 4 times higher than if you were in the US (0.16 instead of 0.04) :(, I suspect this is due to currency conversion costs.

I could have converted my Canadian Dollar to US Dollar and bought VTI or VUS (other similar funds in USD) but that added more complexity, more currency hedge risks and would subject me to US withholding taxes which I’d have to track and claim back at tax time. Again, I’m all for the Keep It Simple approach which just means I’ll pay a slightly higher annual fee.

Consideration 2: Not all of this money is mine alone, some belongs to Mr. MH and so he had to agree with the latest shift. He bought his previous ETF portfolio after me and although his was made up of the same funds as mine, the timing meant that his portfolio dipped for much longer and his best-performing fund during the pandemic was VCE (Vanguard FTSE Canada Index). Because of this, he felt more comfortable keeping at least some of the portfolio invested in a Canadian stock market ETF.

This meant that our target portfolio allocation was going to look something like 95% VUN and 5% VCN (Vanguard FTSE Canada All Cap Index) – this is a newer, broader ETF than VCE.

I started off by investing the proceeds of our house first. I bought mostly VUN and a small amount of VCN per the plan. Then as we were moving over the proceeds from our Irish ETF portfolio my nerves started creeping in about how over-exposed to the US markets we were. I decided I wanted to build back in some regional diversity and looked for another fund or two to help round out my portfolio. As we add more money we will purchase the other funds to balance it out a bit more.

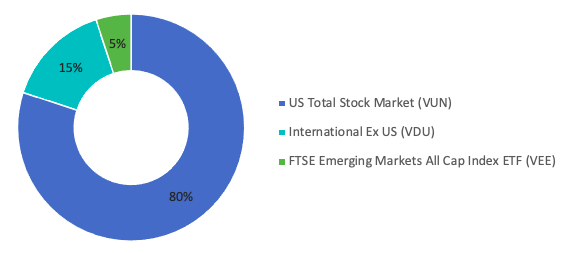

Previously our ETF portfolio was made up of 5 funds. Now I think I can get the diversification I’m comfortable with in 3.

Our new target is something like 80% US, 15% Developed Markets excluding US, 5% Emerging Markets

This should give us a weighted MER of 0.19%, estimated annual growth of 12.02% and estimated annual dividends of 1.58% (based on returns since inception per current fact sheets).

Our current portfolio including our Irish stocks currently looks quite disorganised but I’m ok with that as the estimated returns of the portfolio are slightly better than the above projections. Our current weighted MER is 0.18%, estimated annual returns are 12.28% and dividends of 1.37%.

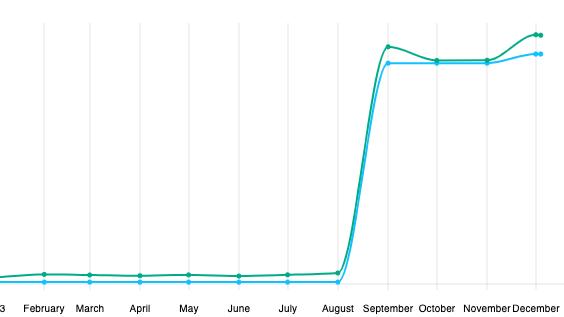

Once you get to a certain level of funds, you can start to see really fun gains or really scary losses on a daily basis. This has been an interesting experience. Our life’s savings are literally all in the stock market. We signed up to an account which lets you consolidate all of your investment accounts into one dashboard with reports. So far our Canadian accounts have gone like this:

The blue line is contributions and the green line is value of investments. So in August, we lumped in our house proceeds and we saw a nice uptick, very shortly followed by a downturn which didn’t go below our initial contributions but was still a drop of 24,000$ in the span of a few weeks. Thankfully, this has now gone back up to above where it was at the previous peak but before you go putting large sums into investments, be sure you are committed to the buy and hold strategy as the smallest drop in your share price can result in big drops in your portfolio. If you sell when it dips, you are locking in your loss, but if you hold on for long enough it will recover.

The current year to date returns are coming in at 14.53% not including dividends.

Different accounts

Another thing I haven’t gone into yet are the different investment accounts available in Canada. As soon as we got back, we opened up a number of new accounts under each of our names in order to maximise our tax benefits. Below are the different accounts we currently hold in each of our names.

- Tax-Free Savings Account (TFSA)

- Register Retirement Savings Plan (RRSP)

- First Home Savings Account (FHSA)

- Margin Account

The TFSA gives you a certain amount of money you can invest per year tax free. This is after tax income but grows tax free and is tax free on withdrawal. Unfortunately for us, your contribution room stops growing once you are out of country so we only have a portion of the 88,000$ room other Canadians have. Still it’s a great account to have.

RRSP’s are similar to Irish pensions in that they are tax-deferral accounts with annual contribution limits where you contribute to them in your higher earning years to reduce your taxable income, the investments grow tax free until withdrawal, at which time you pay your marginal income tax rate. The benefit Canadian RRSPs have over Irish pensions is that you can easily open an account and manage the funds yourself and there is no minimum age for withdrawal.

FHSA’s are tax-free savings accounts to help people save for their first home. There are annual contribution limits up to a maximum of 40k, contributions are tax-deductible, growth is tax-free and withdrawal is tax-free. Contrary to what the name implies, if you have NOT owned your primary home in Canada in the last 4 calendar years, you are still eligible for an account. If you do not decide to buy a house in the end, you can roll the money into your RRSP without impacting your RRSP contribution limits. Your contribution room only starts growing once you open an account so even if you don’t intend on investing/saving for a home, it might be a good idea to open an account just in case you do in the next few years.

Margin accounts are your usual taxable after tax investment accounts.

As we’ve been out of country for 9 years, our contribution room in our TFSA and RRSPs are not as high as they could be but something is better than nothing. So for now, we have maxed out our TFSAs, RRSPs and FHSAs and lumped the rest in our Margin accounts. As I haven’t worked much this year, this may seem like a waste as I won’t have income tax to reduce but getting the money invested and allowing it to grow as soon as possible will outweigh the tax savings I would have made if I had spread it out over higher income earning years.

There is also a Registered Education Savings Plan (RESP) we may look into for our son but I’m not 100% sold on the benefits vs. restrictions. Should our son not go to third level education in Canada, your marginal income tax is charged on withdrawal PLUS a 12-20% withdrawal penalty. For now I’ll just keep investing in our other accounts and use those funds to pay for college if needs be.

As Forest Gump once said: That’s all I got to say about that.

Hi. Thanks for all the info. Curious about when you move the money from Ireland to Canada is there tax implications or do we need to report it on the year end Canadian tax form. Myself and a few other friends have moved from Ireland to Canada at different periods over last decade. I also have a similar setup to you with my investments in Canada.

That’s a complicated one and the short answer is, it depends. It depends on your tax residency, ordinary tax residency and tax domicile as well as the source of the income. Some detail on those here: https://mrsmoneyhacker.com/tax-loopholes-for-irish-investors/ – also there is a double taxation treaty between Canada and Ireland which means if you’ve paid tax on something in Ireland but it is due in Canada, you can claim what you paid in Ireland against what you owe in Canada. Best to have a call with a cross border tax specialist to assess what you need for your specific situation.

For us, the majority of the funds were from the sale of our primary residence so there were no taxes or filings due on that. As I am still ordinarily tax resident in Ireland for 3 years, I will owe taxes there on my Irish sourced investment income which I will also declare on my Canadian tax filing and claim back what I paid in Ireland as a credit. Hope that makes some sense?