Table of Contents

What is the FIRE movement?

As I mentioned in my About Page , I first heard about the FIRE (Financial Independence/Retire Early) movement on a radio show where fellow Canuck, Kristy from Millennial Revolution briefly covered the topic which explained how herself and her husband retired in their early 30’s and have been travelling the world on their investment income for the past 4 years. They are only 1 of many couples, families and individuals I have since come across who are following the same principles to gain financial independence well before the traditional retirement age, all doing very different things with their time.

At a high level the concept is based on having enough investments where the annual returns cover your annual expenses so that you never touch the principal and your funds never run out.

How much do you need?

Studies have shown that if you withdraw 3-4% of your investment/retirement portfolio per year there is little to no chance of you running out of money as your investments will generally bring in more than that and so you are never touching your principal investment.

In order to figure out what this number is for you, you need to take your annual expected retirement expenses and multiply them by 25. This is likely 10-20,000 less than your current annual expenses per couple – read on to see how.

If we take the average Irish expenditure as per the central stats office’s 2015 survey of 40,000€ and take off 10,000€ that comes to an investment of 750,000€. Now when I first saw this figure I was very deflated but it’s actually much more achievable than you think considering the goal is to retire years before you turn 65 (or a typical 40 working years).

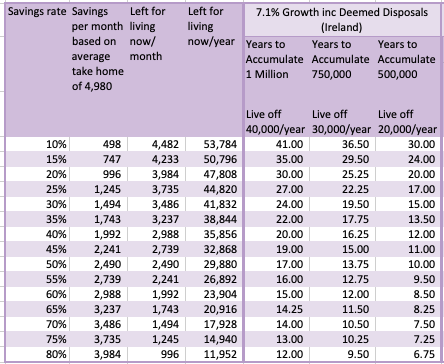

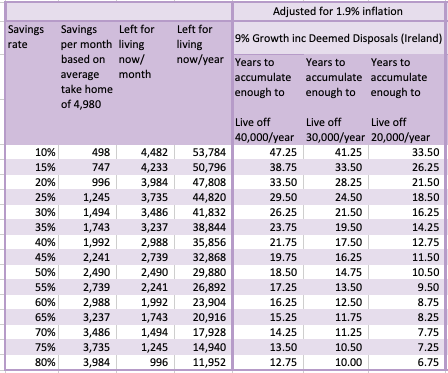

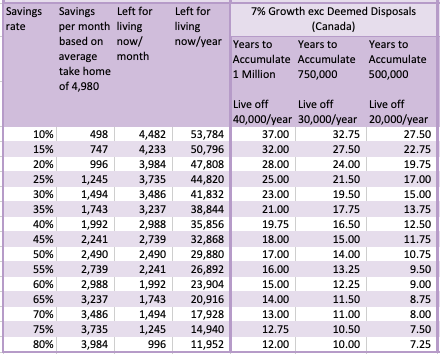

Below are my estimations on how many years would be required to save 1 million (live off 40,000€/year), 750,000€ (live off 30,000€/year) and 500,000€ (live of 20,000€/year) depending on what you think you could live off or supplement your income should you want to continue working. This is if you are starting from zero and does not take into account any liabilities or assets you may currently have.

I’ve included 4 growth variations. Historically the stock market has averaged 9-11% growth, if you are investing for the long-term, you should be able to get these returns as well – though historic trends are no guarantee of future returns it is all we have to use as a basis for projection.

Irish Growth

This chart shows 7.1% growth which is the likely growth you will see in Ireland if you invest in Irish or EU domiciled exchange traded funds (ETFs) – which I will expand on below. This takes the typical 9% minus 1.9% for inflation (this is the average inflation for Ireland in the last 30 years). This leaves us with 7.1%. I have also taken deemed disposal into account in the growth for this one. Deemed disposal is a tax legislation for Irish and EU domiciled ETFs where you need to pay 41% on any gains 8 years after the gain was made whether or not you have actually sold any funds. You may pay for this tax however you wish but for my analysis I am assuming you have no extra funds available outside of your investment and the tax will come out of the investment fund reducing the overall growth rate.

This chart looks at the same thing but accounts for inflation differently. Instead of knocking it off the growth rate I left the growth at 9% but increased the withdrawal amount by the inflation rate to see if it made any difference. It adds an average of 1.55 years to the time to financial independence. This also includes deemed disposals against the growth.

Canadian Growth

This chart shows 7% return which is the likely growth you will see in Canada. This is a more straight forward 9% minus 2% for inflation (the historical inflation for Canada in the last 30 years) with no deemed disposals included.

This chart looks at the same thing but accounts for inflation differently. Instead of knocking it off the growth rate I left the growth at 9% but increased the withdrawal amount by the inflation rate to see if it made any difference. It only adds an average of 3.6 months to the time to financial independence.

Impact of savings rate

In all cases the time to retirement is most impacted by the earlier increases in savings rate. For example increasing your savings rate by 5% from 10 to 15% gets you to retirement 15%-18% faster depending on the final withdrawal amount but when you increase your rate from 75% to 80% it only reduced time to retirement by 4%-7% depending on the final withdrawal amount.

The lower return at the higher rates is because you are not benefitting from compounding interest for as long, so your portfolio growth is mainly from your contributions rather than interest at the higher savings rate but that is offset by faster time to financial independence.

Ways to Reduce Your Retirement Number

As mentioned above, even if you live off 40,000€ now, you will likely need much less once you and your partner are no longer working as you are actually paying to work. You pay for your commute, your work clothes, work lunches, extra take out as you are too tired to cook, cleaners for your house, childcare etc. I’d estimate that you could knock off 10,000€ annually should you no longer need to pay for these things. Since I have been on maternity leave our household expenses have gone down by 550€/month at last check, and that was before we cut down on meat and suspect that figure is actually 750€/month (9,000/year) with just one person no longer in work. I need to analyse where those savings are coming from but will save that for another post.

Additionally, should you wish to partake in geo-arbitrage (living somewhere else that is cheaper for the same standard of living), you could knock another 10,000€ or so off. Looking at this cost of living comparison website it gives you an idea how much farther your money would go in another city. For example: You can get the same standard of living in Faro, Portugal for 1,642€ less per month compared to Cork, Ireland (19,000€/less per year) – that and better weather ;). This even works to compare different cities in your own country.

Another option is, say you manage to save 50% of your household income (live off one persons salary), once you get to 500,000€ in 10-11 years, one spouse could “retire” to stay home with the kids while the other keeps working. Or you both pair back your hours to part time.

If 10-11 years seems too far off, you could also partake in mini-retirements. Once you have a bit of money invested and can afford to take a few months off work, you and your partner or you alone could take a mini-retirement to pursue some other projects, travel for an extended period of time, focus more time on your family, pursue a job you like better, go back to school or just recharge if all you think about is time off.

The options are endless once you have a bit of financial freedom/ independence.

Ways to Reduce Your Time to Retirement

At a high level, though this seems obvious, you could either earn more money – which you would in turn invest or reduce your spending, again to increase your savings rate. Or better yet some combination of both.

There are many ways to go about doing both including side hustles, negotiating wage increases, and various life hacks to reduce your highest expenditures, which in Ireland are: housing, transport and food (making up 50% of the average household expenditure).

Stay-tuned for future posts on these ideas.

What do you invest in?

Most of the FIRE bloggers invest in some proportion of equities/stocks and bonds using self directed brokerage companies. The simplest/laziest investing approach is to invest in stocks using low cost exchange traded funds (ETFs) – these are index funds which essentially invest in the whole stock market. I will go into my Canadian and Irish portfolio splits in future posts.

These ETFs historically have performed as well if not better than individually selected stocks or managed funds, the idea is that the stock market performs at about 9-11% per year over long periods so if you are invested in the whole market you should get these returns too. These are meant to be long term investment vehicles as you need time to weather out any downturns in the market. You also need to be ok with leaving your investments untouched especially during downturns as you need to allow time for the market to recover as it always has – as per below (Irish stock market in green and Canada stock market in blue), you can see that in the history of the stock market, it has always recovered over the long term, say 10-15 years after any downturn (though we’ve yet to see a full recovery from the crash of ’08 in Ireland just yet).

Depending on how long you have before you plan to withdraw you will want to invest the highest percentage of your portfolio in stocks (higher risk/higher return) and only a small percentage in bonds (lower risk/lower returns). Personally I am investing 100% in stocks for now and will rebalance my portfolio to include some bonds closer to my withdrawal date. When you are about 5 years from retirement you will want to have a split of about 60% stocks and 40% bonds, or if you plan to keep making some income you can leave a higher percentage in stocks.

Investing in ETFs in Ireland is a little more time consuming and requires more administration than some other investment vehicles, in that your gains and dividends are not automatically reinvested for non-accumulating ETFs and you have to file taxes every year but I will post details on this process as I navigate the system myself. For Canadian readers: In Ireland, you do not need to file taxes every year unless you have any other income outside your salary so filing taxes is expensive and more complicated to figure out yourself.

Investing in ETFs in Canada is much more straight forward.

There are other investment vehicles like pensions, peer-to-peer lending, real estate etc but I will go into why I’m not opting for these in future posts.

Why Retire Early?

I used to think that winning the lottery would be a curse as I personally get so much out of making goals and working towards them and I felt like winning the lottery would take the work/reward element out of the equation and I would feel lost. I thought, there is only so much travel you can do before it gets old, and only so many material things you can accumulate before you have everything you’d ever possibly need, and then what?

The same thought process would go for the idea of retiring early, until I probed a bit deeper and asked myself – if money was not needed, what would I do with my life? After all, humans need work to give purpose, feel productive, remain socially engaged and creative.

If you’ve ever come across Maslow’s hierarchy of needs and motivation, no longer needing money kind of puts you further along the path to self-actualisation and transcendence needs where you think and act more on behalf of others rather than yourself.

For me I think I would spend more time helping people either with finances or volunteering with the homeless, and become more active in the environmental activism community, maybe find a non-profit (typically low paying) environmental company that could benefit from my analysis skills – mixed in of course with more time with family and friends, outdoor adventures, travel and maybe some interior design work/flipping houses.

I recently read a finance book* which mentioned that most people never really stop to think about what they’ll do when they retire and so when that day comes, they feel lost and don’t know how to pass the time, he commented that one of his neighbours goes into his lawn to pick up sticks every day – this is such a waste of life! We have only one life, and we rarely question the status quo of going to school, getting a good job, work 40 years, retire. What if you could design a life where you retire sooner and make an impact or see the world while you are still young and fit enough to enjoy it?

What do you think? Are you as intrigued and inspired by the FIRE movement as I am? What would you do with your time if money was no longer needed? Leave a comment below!

* The link to the book is an affiliate link so if you buy it, I will get a small portion of the book price.

2 thoughts on “The financial independence/retire early (FIRE) movement explained”