In a previous post we looked at how investing just 127€/month while paying down your mortgage as slowly as possible could cancel out your mortgage interest, but today I’m going to show you how paying off your mortgage as quickly as possible could cost you over almost 6 years of your life.

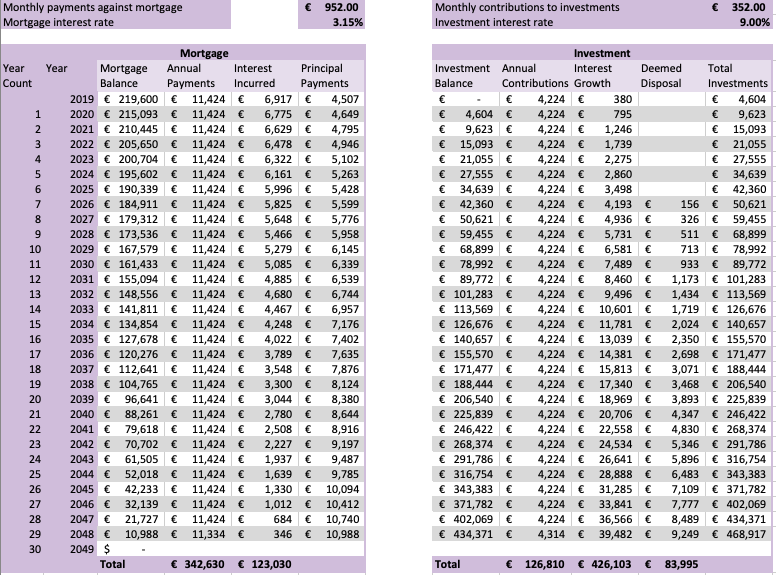

Using the same assumptions:

Mortgage

House price of 244,000

Loan of 90%: 219,600 (average mortgage loan as per 2017 Central Bank report)

30 year mortgage

3.15% interest rate (average rate as per 2018 Central Bank report)

952€ monthly payment

Investment

9% rate of return (average historical stock market returns)

Growth calculations take into account 41% tax on growth every 8 years (deemed disposal)

352€ monthly contribution (average disposable income for houses with mortgage in Ireland as per Central Stats Office 2015 survey)

Inflation excluded in both mortgage rate and investment growth as future payments will be made with future money which already accounts for inflation.

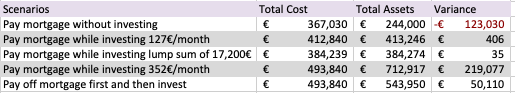

As we saw in the previous post, option 1 of paying off your mortgage as slowly as possible while contributing 127€/month to an investment account will cancel out your mortgage interest and you end up with assets worth what you paid vs 123,000 less.

Looking at option 2, and increasing your investment amount to 352€ you not only cancel out your mortgage interest but also end up with a assets worth 712,917€ (244,000 house + 468,917 investments) or for an outlay of 493,840 you end up with assets worth 168,967€ more after 30 years.

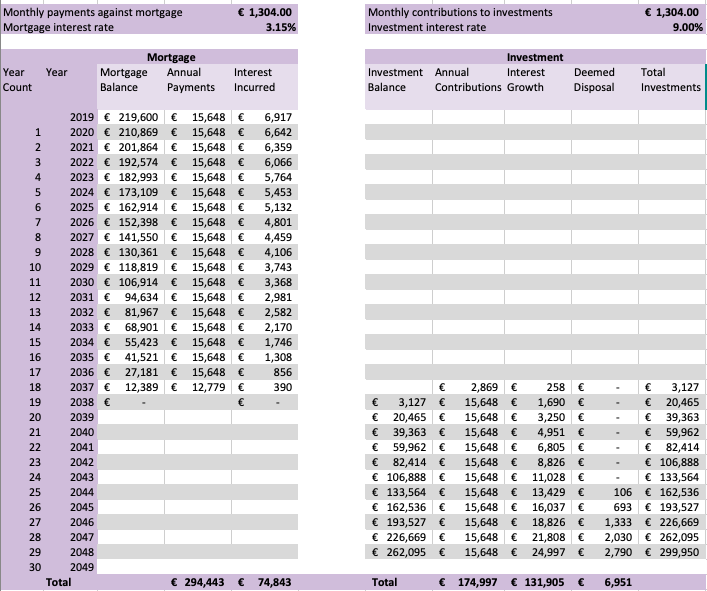

Looking at option 3, using the same funds of the 952 mortgage payment + 352 additional contribution, that gives you 1,304€/month to pay down your mortgage as quickly as possible without investing at the same time. Let’s see how those figures play out.

While your mortgage is paid off 12 years sooner and you save 48,187€ in interest (123,040-74,843) you also lose out on making 217,154€ in net interest minus deemed disposals that you would have if you had invested alongside. So with the same outlay of 493,840 you end up with a portfolio worth 543,950 which is 168,967€ less than if you pay it off slowly and invest alongside.

Summary below:

If you convert that difference into time, which is after all the most precious of resources, using the central stats office’s 2015 household income survey’s average take-home of 29,880 – this equates to 5.65 years full salary. That means you would need to work an entire 5 years and 7.8 months MORE of your life to pay off your mortgage quickly instead of investing at the same time as paying it off slowly. Or if you split it with your partner that’s nearly 2 years and 10 months more each that you could be spending together doing something you love.

Interested in how these numbers look with larger monthly investments? Check out this article.

Very good. Thank you!