I’ve been getting increasing questions from both friends and clients about investing in a post-tax account with financial advisors in a particular fund. This must be getting heavily advertised somewhere or advisors are getting big commissions for selling this and I wanted to do some analysis on the true cost so people could make their decision with eyes wide open. This post highlights the true cost of investing with a financial advisor in a post-tax life assurance product.

Firstly, I want to preempt this to say I don’t think all financial advisors are bad and that they need to get paid for the service they provide but I do think that a lot of people, including some advisors, aren’t truly aware of the fees and the impact of them long term which is the purpose of this post.

In this post, I will compare investing in the Zurich Dynamic Prisma Fund through a financial advisor and investing on your own in a simple S&P500 accumulating ETF tracker in a self-directed online broker account.

Some definitions

Life assurance investment product: This is the term used for a post-tax investment account sold by a life assurance company. My understanding is that a company that sells life assurance policies can offer post-tax investment products, typically sold by financial advisors on their behalf, but these products do not carry any life insurance or assurance benefits, they are just called life assurance investment products as they are offered by the company that provides life assurance policies, though I’m happy to be corrected on this.

Government levy: As of the 2009 Finance Act, the government apply a 1% levy on all premiums paid to all life assurance companies. The levy applies to most types of life assurance policies including:

- Protection

- Savings

- Investments

Initial commission: When working with a financial advisor, by law, they must now make it clear what commission they make by selling you a product. My understanding is that initial commissions are taken on all contributions made for the first year of holding the product. So if they charge a commission of 5.25% and you invest a lump sum of 100k, they will only invest 93,750€ after 5,250€ commission and 1,000€ government levy are taken out. This can make a significant impact on long term compounding as you’ll see below.

Another note on this is, if your advisor is continually getting you to switch funds, really take a look at the initial commission as they would be getting a HUGE portion of your investments every year. For example: they get an initial commission of 5% in year 1, they change you to another product in year 2 with another initial commission of 5%, and you’re only making 10% in the fund, essentially you are giving them half your gains every year. Though, it should be said that it’s not in the interest of most advisors to switch on the detriment of their clients, just something to question if you have a questionable advisor.

Ongoing charge: This is an annual percentage fee charged on the total value of the fund under management, whether you make money or not. So if they charge 1% and in year 1 your portfolio is worth 100k, they will make 1,000€, by year 30 your portfolio could be worth 500k or 600k and they will make 5k and 6k/year in commission. Again this can have a major impact on your compounding over time.

Clawback: Some advisors have clauses where if you do not stay invested in a certain product for 5 years for example, they can “clawback” any commission they should have made over that timeframe. So if you invest a lump sum in year 1 and, in year 2 hit some financial difficulty and need to sell your investments, the financial advisor could take the commissions they should have made for the remaining 4 years. So if you invest a lump sum of 100k and the ongoing charge is 1%, and the clawback applies to the first 5 years, you could be liable for 4k in early exit fees. Again, I’m happy to be corrected on this but this is what I could deduce from my research. I’ve been advised that Zurich currently also offer no exit contracts, which allows clients to move out with no penalty, often to the detriment of the broker who get all their earnings taken back.

Product comparison

| S&P500 Acc ETF | Financial advisor 1 | Financial advisor 2 | |

| Initial commission/purchase fee | 0.032% | 0% | 5.25% |

| Ongoing mgmt fee | 0.07% | 1.25% | 1% |

| Government levy | 0% | 1% | 1% |

| Performance including reinvestment of dividends | 11.77% | 11.1% | 11.1% |

| Tax treatment: 41% exit tax on gains and dividends + 8 year deemed disposal | Yes | Yes | Yes |

| Tax filing required | Yes | No | No |

| Penalties (clawback) for withdrawing | No | No | Yes |

Assumptions:

Zurich Dynamic Prisma Fund shows a performance since inception in November 1989 of 11.1%. This includes reinvestment of dividends and excludes any taxes, initial commissions, government levy’s, or ongoing management charges.

S&P500 performance for the same time frame was 10.39% not including reinvestment of dividends. Dividends averaged about 1.38% for that timeframe coming to a combined performance of 11.77%.

I’m going to look at investing a lump sum of 100,000€ and see the total value of each option after 30 years.

Buying the S&P500 accumulating ETF with dividends automatically reinvested results in a once-off purchase cost on Degiro of 32€. It charges an ongoing annual fee of 0.07%.

Financial advisor 1 doesn’t charge an initial commission and has no clawback clause but charges a slightly higher ongoing charge of 1.25%.

Financial advisor 2 charges an initial commission of 5.25% and has a clawback clause but charges a slightly lower ongoing annual charge of 1%.

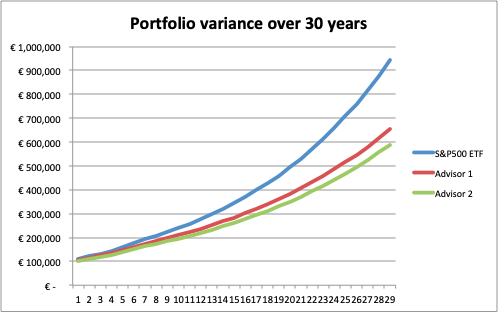

Comparison after 30 years:

After 30 years, looking at these 3 scenarios, lumping in 100,000€ in year 1 and taking out the 41% exit tax on gains and dividends every 8 years results in the below portfolios.

| S&P500 Acc ETF | Financial advisor 1 | Financial advisor 2 | |

| Portfolio value after 30 years | 942k | 654k | 589k |

| Variance | 287k | 352k |

This goes to show the impact of initial commissions, ongoing fees, and government levy. It also goes to show that having a higher ongoing commission can actually result in more returns than having a high initial commission.

Considerations:

When you’re starting to invest, putting a large sum of money into anything can be scary and giving your money to someone more qualified than you can feel like a safety net but this can come at a real cost as you can see in the demonstration above.

I would also argue that if you are not comfortable with the risk of investing, then starting with the Dynamic Prisma fund is particularly high risk in terms of the underlying fund asset allocation which your advisor should help educate you on.

The Dynamic Prisma fund is in 93% equities, 4% cash and 3% bonds. This is high risk in nature and explains the high return over the years. High risk means potentially higher rewards in the long run but with ALOT of volatility in the short term.

If you don’t feel confident leaving money in the market when it dips then having the funds “locked” away with an advisor may suit you if you feel like you need an additional barrier to stop yourself from selling when the markets fall. A good advisor would help coach you through leaving your money invested in downfalls, though again, this comes at a real price over the long run.

I hope this gives a bit more clarity on the true cost of investing with a financial advisor in a post-tax savings account. If I have gotten any of the above wrong please do let me know but this is what I could piece together to date.

Mrs Money Hacker,

Although your analysis is interesting. The fees and charges you have shown for Financial Advisers on Investments isn’t representative of what is being charged in the Industry, or even allowed by Zurich.

There are also a few errors in your blog which can give consumers the wrong information.

Regards

Eoin

Hi Eoin, Thanks for the feedback. I’d be delighted to be proven wrong, to be honest. Happy to update if you could shed a bit more light around what I got wrong? The fees I used were taken from 2 websites in the publicly listed fees, am I not applying them correctly?

Hi Megan,

Thank you for the insightful article.

Maybe something trivial, but one thing that surprised me was the tax filing under the Product Comparison table. I hadn’t realised tax filing would be necessary in the case of buying funds (e.g. Zurich Prisma or Irish Life MAPs).

In fact, I thought it was part of their appeal. I believed the financial provider was responsible for calculating and filing the tax returns on your behalf.

If it is indeed the case, that you are responsible to file your own tax returns, it does significantly lessen the attractiveness of those funds. It wouldn’t surprise me that they’d obfuscate this responsibility.

Out of interest, I’d appreciate some confirmation on the above if you were willing to oblige.

Thanks again,

G

Hi Megan,

Why are you comparing “investing on your own” with no advice, with an advisory service?

The indicative equity range of the Dynamic Fund is 75% – 100%. It’s actively managed & it’s not a 100% equity fund. Comparing it to S&P500 is questionable.

It’s not that difficult to get a 101% allocation to compensate for the Government Levy.

You have (generally) 4/6 free fund switches in an investment product in any one year so the 5% initial commission (again) is nonsense.

You refer to the Dynamic Fund being ‘high risk’ but no such comment on S&P500 (wholly equity) index.

What’s the average holding period for an ETF and for a Life Assurance Investment product?

Hi Gerard, Thanks for your feedback.

The reason I’m comparing investing on your own to an advisory service is based on my own experience, I managed to make more money investing on my own than I ever did with an advisory service, largely due to the fees I was paying, the true impact of which were never made clear to me. I think it’s important to demonstrate the cost of the advice for those that are comfortable investing on their own and leave it up to individuals to make the call if that cost is worth it to them.

Also, I agree the dynamic fund and S&P 500 are made up of different equity allocations however, the point I am trying to make is that you don’t need much knowledge of the markets to invest in a simple S&P 500 tracker to achieve a similar performance to what you could get with an advisory service through the dynamic fund. Even if I compared to a 100% equity fund like International Equity Fund with a 10 year performance of 11.44% it doesn’t make much of a difference to the end figures as the biggest hit is the initial commission and ongoing annual fees. Even the 101% allocation doesn’t make a huge difference.

Fair point on the free switches, I can update to make mention of that as something for people to look for if they do go with an advisory service.

In terms of not mentioning the S&P500 being high risk, I can clarify that it is also high risk, but basically what I was trying to say is that if you are not comfortable with the risk of investing and feel the need to use an advisory service then it may be more prudent to consider a lower equity split (which would also exclude the S&P 500).

Not sure about the average holding period as I’m sure that’s a personal choice? I do know that most ETF investors that I have come across in forums and community groups are long term buy and hold investors, which I’m guessing would be similar to a Life Assurance product. This would also explain why the deemed disposal came to be as the government wasn’t getting money from people buying and holding for long periods of time.

Hi Megan,

I would like to see a reply to Gregory’s point. Why didn’t you reply to him but did to the next comment?

David

Hi David, Thanks for the comment. I think I did reply to him and I did update the article with his point however I did an update to my site around that time and had to refresh from a backup so lost some comments and replies. Gregory was right and I updated the article to reflect this.