If you’re lucky enough to have an employer that provides pension or RRSP matching as a benefit, it seems like a no brainer to maximise whatever portion you need to, to get the full match, after all it’s free money or a 100% return on what you put in!

EXCEPT….

There are some scenarios where this doesn’t work out in your best interest. This concept applies in both Canada and Ireland so I will refrain from mentioning specific currencies throughout the post.

Like we saw in the mortgage vs investment posts, it all depends on what management fees the group fund is paying and what growth rate it’s getting compared to what you could get in a self-directed account.

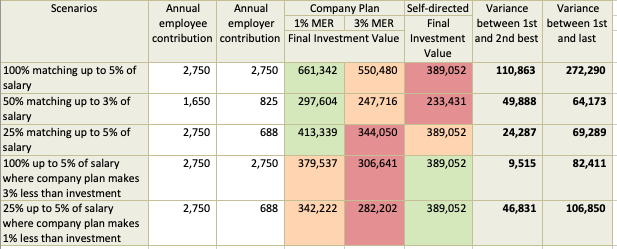

To demonstrate my point I looked at 5 different scenarios.

Assumptions:

- Salary: 55,000

- Growth term: 30 years

- Self-directed fund has MER fees of 0.23%

- Company fund has MER fees of 1% or 3%

MER fees are Management Expense Ratio fees which are charged on the overall value of your fund annually.

Scenarios:

- 100% matching up to 5% of salary where company plan and investment make 9%

- 50% matching up to 3% of salary where company plan and investment make 9%

- 25% matching up to 5% of salary where company plan and investment make 9%

- 100% matching up to 5% of salary where company plan makes 3% less than investment

- 25% matching up to 5% of salary where company plan makes 1% less than investment

Here is what I found where the best option is in green, mid-option in orange and worst option in red:

So generally speaking if the company matches higher percentages and makes the same growth you could get elsewhere then 1% or even 3% MERs still make more than you would elsewhere.

When your company makes smaller contributions or you could make 1-3% more in investment growth elsewhere then it makes sense to invest elsewhere.

So before you go upping your contributions to maximise your employer matching, ask you HR rep for details of the fund they are investing in and use this as a general guide to figure out if you’d be better off foregoing the free money and investing your portion elsewhere.

Questions to ask your rep would be:

- What is the fund invested in?

- What are the MER fees?

- What growth has it seen as a percentage historically?

- Is there a vesting period? – this is a minimum period of time that you need to leave the funds in your company’s group scheme before you move them elsewhere/sell them even if you leave the company

- Are there deferred sales charges (DSC)? – this is an early discharge fee, it can be a sliding scale which reduces by percentage per year the closer you get to the end of the term (think this is Canadian only)

If you do set up your own self directed account, as these are retirement/pension funds with deductions at source you’ll need to make sure you set up the correct investment fund to ensure your company can contribute pre-tax.

Another option you could consider is to make use of the matching and then transfer those funds into your self-directed account once you have access to the matched amount (usually subject to a vesting period).