When I was 28 an investment/life insurance company came into my office as part of a lunch and learn on financial wellness, they offered a free one-on-one session to look at your finances and tell you how much you would need to retire, they also offered investment options to help you get there. At the time I knew nothing about investing and the fund they described looked pretty good, after all making something from my money was surely better than making nothing. However, what wasn’t mentioned was a little thing called Management Expense Ratio (MER).

MERs are management fees which are charged as a percentage against your total portfolio regardless if you make or lose money in the fund. Now I understand the people putting together and managing the funds need to get paid but there are passive tracker funds which achieve the same if not better results and only charge a fraction of the fees. These fees also compound along with your portfolio growth so they increase every year just as your portfolio (hopefully) does. These fees are not even listed on your annual statement but, bless their hearts, are available upon request.

My total investments with this fund came to 23,336 in two lump sums. Over the nearly 6 years I was invested in the fund my account averaged 4.4% growth from 2013-2018 and ended with a book value of 30,000 or nearly 6,750 in growth. Not bad but not great considering the average stock market growth is 9-11%/year. The fund also took 2.49% in MERs which I figure amounted to about 3,800 (more than half of my overall growth)!

Towards the end of 2018 I had read up a lot more on investing and was ready to make the jump to self-directed investing (where I picked my portfolio myself in order to dramatically reduce fees). Now at this time the markets were down and so my 30,000 could only get me 28,000 on the open market and I would also be charged an early withdrawal fee of 700 or so as a deferred sales charge (DSC) since the fund I signed up to was locked in for 7 years and subject to early withdrawal fees. So, I would take a nearly 2,600 hit, completely wiping out my last 2 years of gains BUT my rationale was to sell low but also buy my new investment funds low and make a bigger portion of the returns when the market recovered. This loss meant my fund actually only performed at 2.59%/year, just slightly over the 2% average inflation.

Now I could have waited another year until my 7 year term was up and save the 700 but I think that my new funds will make back my loss and then some within the year.

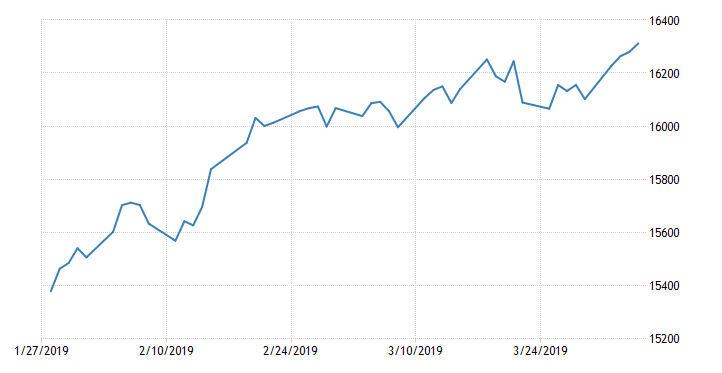

As of today, only a little over 2 months after I transferred in the funds, my new self directed fund is making 7.08% and I’m up 1,945$ (albeit unrealized for now) which is almost what I made in 2 years with the other fund! I will keep you posted on how they perform throughout the year and see if my fund out performs the actively managed one with the high MER.

As you can see by the graph above the overall trend is up and mirrors the trend of the overall Toronto stock exchange for the same time frame.

As I’m invested in a number of exchange traded funds (ETF) – tracker funds which track a large portion of the market – each fund has its own MER. I have calculated my portfolio’s mix to a weighted MER of 0.23%. I also estimate that my annual return will be about 8.7% based on a weighted average of the previous 5 year’s returns for each of the funds I’m invested in. I will go into more details on this portfolio and how to transfer an RRSP from a managed account to a self directed one without incurring withdrawal taxes in another post.

According to this guy’s free MER comparison calculator, even if I didn’t invest anything else into the account until I was 50 (a 22 year investment), I would have 22,000 LESS than if I invested in something with a 0.23% MER with the same 4.4% return. That’s the same value of what I put in! OR another way of looking at it, a portfolio worth 34,000 (2.49% MER) instead of 57,000 (0.23% MER). If I waited until 60 to withdraw I’d have 44,000 less just to a difference of MER never mind the better annual returns I’m hoping on achieving!

Stay tuned to see how this portfolio pans out!