Why Transfer

As I mentioned in this post you may be paying high management fees with your current RRSP investment provider which could potentially be halving the profits you could be making in a self-directed account.

If you are ready to take the plunge and manage your investments yourself with simple ETFs (exchange traded funds) which automatically invest in a large portion of the stock market essentially following the long-term upward trend of 9-11%, then you can follow the below steps:

How to Transfer

- Sign up for Questrade – a self-directed online brokerage account which has fee ETF trading (use the link provided to give me a small commission at no cost to you)

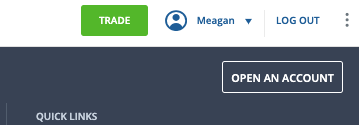

- Once signed up, click on “Open and Account” in the top right corner

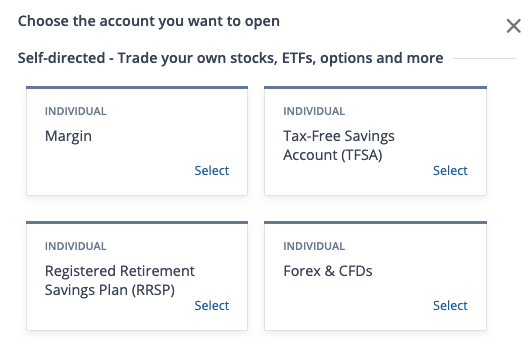

- Select Individual RRSP account (make sure you select this one as you will incur withdrawal taxes in the transfer if you select any other ones)

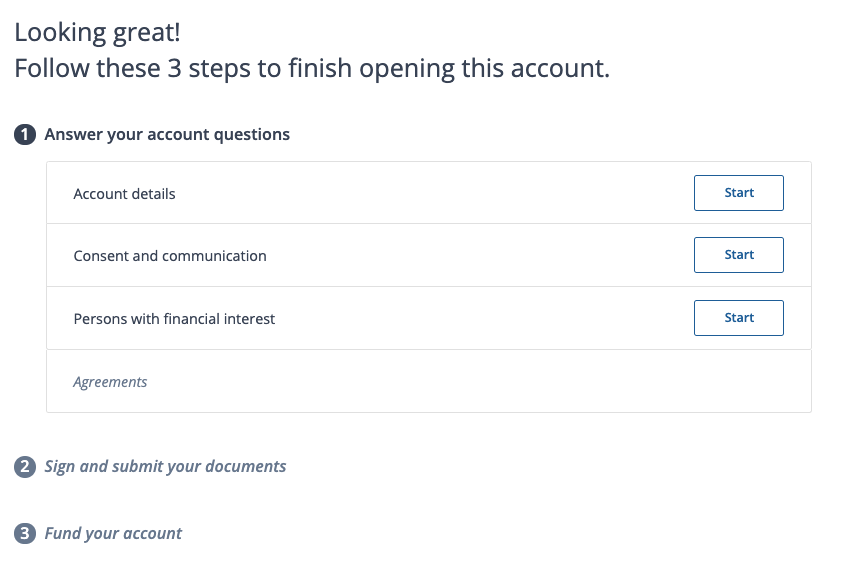

- Follow the remaining steps to setup the account

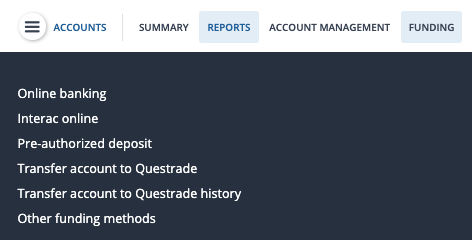

- Once the account is setup you will have the option to transfer funds into the account, in the main menu select Funds and then click “Transfer account to Questrade”

- Fill out your current RRSP institutions information

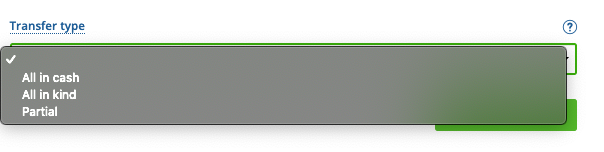

- Select the transfer type of either cash, in kind or partial. In kind can be used if you like what you are currently invested in but want to reduce your management fees. You can only use this if the fund you are invested in is not proprietary to the institution you are currently invested with. Cash means the funds in your current RRSP will be sold and only cash will be transferred which gives you a blank slate on what to invest in. Partial is some combination of the two.

- Questrade will take it from there, they will contact your institution and complete the transfer. They will also make the transfer as registered which means you will not pay withdrawal taxes as you are simply transferring from one RRSP account to another. They say it can take 20 business days but mine took less than a week. Note there is a fee of 150$ for transfer amounts less than 25,000$, also make sure you are not invested in DSC (deferred sales charge) funds which charge you a certain percentage to sell before a certain number of years, you should be able to see this in your current investment account if they offer a redemption fee calculator. If you are invested in a DSC account you can make the decision to see if the fees you will pay will easily be made up in a shorter time frame if you invest yourself – like I did here.

What to Do Once Transfer is Complete

If you transfer in-kind there is nothing left to do but monitor your account and perhaps rebalance or reinvest any dividends (I will write more on this later) and if you transfer in cash then you need to decide what you will invest in. I will write another post detailing my own portfolio should you wish to follow along.

And that’s it, your first step to investing!

1 thought on “How to Transfer Your RRSP to a Self Directed Account”