A lofty title I know, but I just finished reading the updated version of Your Money or Your Life by Vicki Robin and Joe Dominguez and I really feel like it is not an understatement. I had read about the book on many Financial Independence blogs and thought I’d give it a go.

Going into it I thought, “What could I really learn that I don’t already know?” I’m already well on my way to FI, I track my expenses in detail and have cut my expenditure to almost the core, I’m investing and prioritising a simple life over the rat race without feeling deprived, I realise that time is the most precious resource, not money or status or material goods, what more could there be to learn?

3 questions to transform your relationship with money

While the book reiterates a lot of these things, the heart of the program is where the transformational piece comes in, and it’s about looking at every expense and asking yourself 3 questions:

- Did I receive fulfillment, satisfaction, and value in proportion to life energy spent?

- Is this expenditure of life energy in alignment with my values and life purpose?

- How might this expenditure change if I didn’t have to work for money? and by how much?

For each question in each category, evaluate whether the expense should increase, decrease, or stay the same for your optimal fulfillment.

This is how you reduce (or perhaps increase) your expenses in certain categories to bring the most fulfillment to your life in exchange for the fewest hours at work and time away from family (if that’s what’s important to you). It helps you cut out all the excess without feeling like you are depriving yourself, which would never be a sustainable way to budget.

What is life energy?

As I have gotten older I have slowly evolved to prioritise time over money but this is really driven home by the following extract from the book: “The only real asset you have is your time. The hours of your life. You’re born. You have about eighty-eight hundred hours in a year. Maybe six hundred and fifty thousand hours before you die. You’ll easily spend half of them sleeping and keeping your body fed, clothed, and reasonably comfortable. Maybe you’re already halfway through your life, meaning you’re down to a hundred and fifty thousand hours left to spend. This is your treasure. This is all you have for everything that matters to you—the love of your family, your contribution to society, your enjoyment of the great outdoors, your rising to challenges, your search for meaning, your legacy, your ecstasies [in church or in bed], your life. And you sell some of those precious hours for money —money has no meaning; your time is where all meaning and value lie.

Knowing that money is simply your life energy puts you in the driver’s seat of your money life. How much of my life am I willing to sell to have money in my pocket? Looking around at your accumulation of stuff you can ask, ‘How many hours of my life did I invest to have this . . . chair . . . car . . . matched set of cookware . . . diploma on the wall?’ See what this does to your next purchase.“

Calculating your real hourly wage

Linking to this topic of life energy is the fact that the hourly wage you think you’re being paid isn’t really taking into consideration all of the extra time (life energy) you spend for a specific job. The book guides you on how to figure out your real hourly wage so that you can weigh options with the bigger picture in mind.

It gets you to think about how much time or money you spend:

- getting ready for work

- commuting to and from work

- decompressing from work on evenings, weekends and even holidays where you just want to lie on a beach as you’ve no energy left to do anything else

- alcohol or junk food you consume to de-stress

- ready made meals or take out you buy as you’re to tired to cook

- medications and medical treatments required as a result of stress (mental or physical)

- special clothes or other status items you buy which you wouldn’t need if you weren’t working in that job

- cleaners, landscapers and other services you outsource as you don’t have time

- childcare

and so on.

By figuring out your real hourly wage for a specific job you may realise there are better/less stressful jobs that may pay less or have a shorter commute or have fewer expenses or allow part time work etc which will actually result in the same true hourly wage when you consider all of these things together. When considering a new job, it may help to better see the bigger picture when using your real hourly rate.

There is a calculator on the book’s website but far more detail is given in the book on how to more accurately calculate this.

Finding your “Enough”

The book also talks a lot about the history of materialism, how governments and corporations convinced us that we need more material goods to keep the economy (and their pocket books) thriving and that material goods were the key to happiness when actually, happiness levels in the US have only decreased as consumerism has increased.

In the author’s seminars they asked participants to rate their happiness (from 1 to 5, 1 being miserable to 5 being joyous) along with their level of income and to identify how much more money they would need to be happier. Of the 1,000 participants over the US and Canada, the average happiness rating was between 2.6 and 2.8 regardless if they earned less than 1,500$/month or over 6,000$/month and no matter what they earned, they all said they needed at least 50 to 100% more than they have now to be happy or satisfied!

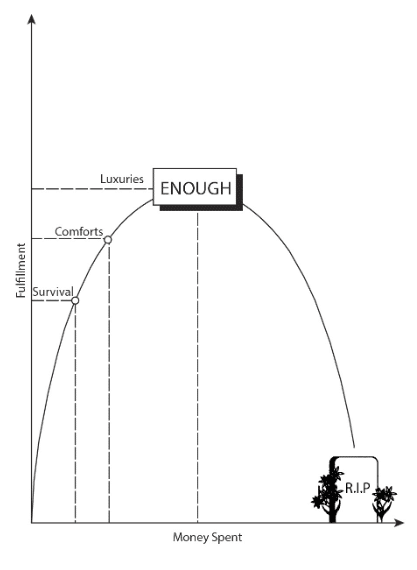

Enter the fulfillment curve. Once your survival needs, comforts and a few luxuries are met, you have reached peak fulfillment. Any money you throw at external things after you reach that point has diminishing returns on fulfillment and ultimately happiness. They key of following the program outlined in the book is to identify your own personal level of enough. The below chart depicts the fulfillment curve.

Enough is not the minimum amount for survival; it is the exact amount that gives you fulfillment without excess.

“Enough” has 4 common components and qualities:

- Accountability—knowing how much money is flowing into and out of your life—is basic Financial Intelligence. Clearly, if you never know how much you have or where it’s all going, you can never have enough.

- An internal yardstick for fulfillment. As we pointed out earlier, you can never have enough if you are measuring by what others have or think. It’s like trying to go up a down escalator. Other people’s opinions are fickle. Other people’s stuff is ever changing, and just when you have the stuff you think achieves that coveted parity with the Joneses, along comes the craze of tidying up and the Joneses are now minimalists. Self-awareness is key.

- A purpose in life higher than satisfying your own wants and desires, because you can never have enough if every desire becomes a need that must be filled. What is a purpose higher than getting what we want? The opposite of getting is giving—and therein lies a secret to fulfillment. Beyond the point of enough, we achieve happiness by expressing our natural desire to offer our gifts and talents to others.

- Responsibility, living for more than just “me, myself, and I.” If we don’t give a hoot about anyone but ourselves, we can never have enough until we have it all.

Tips on finding your purpose

If you, like most of us, have been too busy making a living (or making a dying as they say in the book) to stop and question what your life’s purpose might be, the book also gives a few directions you may take in order to identify this.

- Work with your passion, on projects you care deeply about. What was your dream before you stopped dreaming? What’s the work you would do even if you weren’t paid to do it? You’re not looking for those superficial preferences depicted on bumper stickers, like “I’d rather be surfing.” You’re looking for something you’d give your life to, not something you use to get away from your life.

- Work with your pain, with people whose pain touches your heart. Have you “been there so you know how it feels”—in grief, sorrow, despair, hunger, terror? Can you offer others the wisdom and compassion you gained from this experience? Is there an aspect of suffering in the world that calls you to action? If you are in such pain that you’ve lost touch with your ability to help others, then now is the perfect time to extend your hand to others in pain. It’s healing.

- Work with what is at hand, with the opportunities that arise daily for responding to the simple needs of others. Finding your purpose has often been equated with discovering the perfect job or service project that will galvanize you to be as saintly as Mother Teresa. This suggestion to work with what’s at hand is a reminder that in an interconnected world all acts of service contribute to the good of the whole. If you remember that there is no single act of greatness, just a series of small acts done with great passion or great love, then in doing what you see needs to be done—taking dinner to a sick neighbor, helping a child learn to read, writing a letter to the editor of your newspaper, being an advocate for the homeless in your city—you will discover a life filled with the experience of having a purpose worth living for.

Life’s purpose is a chosen dedication of your life energy to something you believe is more important than your individual existence. It becomes your identity and can become more important than life itself.

For some it can be working at something they enjoy and raising a family, others find purpose being engaged in and giving back to their community.

Purpose can change over time so keep this in mind when aligning your spending with your purpose.

The difference between natural and national wealth

The book also talks about the difference between national currency and natural currency.

“National currency is the money we all use to trade and invest. Natural currency is the endless shuttling of giving and receiving between people (and all living things) who recognize one another as kin.

National currency is a relatively recent human invention, controlled by financial institutions like banks, doled out by people and institutions we don’t control.

Natural currency came into being with the first living organism, which created a mutually beneficial exchange with other organisms. For any life-form to continue, it needs to provide some benefit for the life-forms around it.“

The ABCs of natural wealth

Abilities includes your skills and knowledge—what you know how to do.

Belonging is who walks with you in life.

Community is the society you live in (in real life and even online)—your neighbors, your city, your environment—and nature.

Abilities, Belonging, and Community are the three forms of natural wealth you build intuitively in the process of aligning how you earn, spend, and save money with your purpose and fulfillment. As you take your eyes off the false prize (of more, better, and different stuff), you put them on the real prizes: friends, family, sharing, caring, learning, meeting challenges, intimacy, rest, and being present, connected, and respected.

Build natural wealth during your financial accumulation phase and your FI may come sooner, last longer, and be happier by far.

Redefining your definition of work

The book also looks at our cultural and historical definition of work and how to look at it differently. This is particularly interesting for people looking to “retire early” but also extremely useful for all working people to shift their mindset around what work is and should be.

In history, hunter gatherer tribes used to work about 15 hours a week to provide for themselves, the rest of the time would be spent resting, playing games, socializing and planning rituals – a far cry from the minimum 40 hour week we have now, for a lot of us just to “get by” often at the expense of our most important relationships.

It talks of two different functions of work: material, financial function (i.e., getting paid) and the personal function (emotional, intellectual, psychological, and even spiritual).

Also that growth potential, communication channels, interest in work, and recognition are what make a job satisfying—not pay. All of these things can be achieved in unpaid activities. So once your basic needs are being met by working as few hours as possible (or eventually by passive investment income), the rest (the fulfilling/satisfying parts) could be done in other activities.

Once you’ve gotten your spending aligned with your peak fulfillment, any excess is just that. Perhaps you could cut back your hours at work and do activities that provide more meaning and purpose for you.

And for those wondering about what to do with retirement – Retirement doesn’t mean you stop working. It means you can stop working for money. We all want to be useful, to be recognized by others for the contribution we make. If we think paid employment is our only admirable, respectable, and consequential way to contribute, then who’d want to retire? Nobody wants to be a has-been, washed up, put out to pasture. Disconnecting work from wages means that you are valuable in every role, task, activity—and it might free you to retire a lot earlier so you can give a lot more of yourself to others.

So much of our society has us defining ourselves by what we do. One of the first questions you ask someone is “What do you do for a living?” If you say you’re retired or unemployed people switch off and don’t know what else to say, or make assumptions that you spend your days golfing, but if we can break the link between work and wages then we can start to shift this perception (if even for ourselves so that we don’t have an identity crisis once we “retire” early).

For the Greeks, leisure was the highest good, the essence of freedom—a time for self-development and for higher pursuits. Yet here we are in the early twenty-first century unable to really relax and enjoy our leisure. Even our language betrays us by calling it “time off,” as though leisure were just a few minutes of recuperation before we’re back “on,” a once-again productive (i.e., real) human being. If we did not identify so strongly with what we do for money, we might honor and enjoy our leisure more. It’s OK to play. It’s OK to relax in the shade and listen to the birds. It’s OK to take a walk to nowhere in particular. It’s OK to leave your technology at home and go camping. There is no shame in taking time to do activities alone either. It’s OK to take pleasure in just being rather than always doing. Leisure is not an identity crisis if you know you are not your job.

Other nuggets from the book

On frugality: Waste lies not in the number of possessions but in the failure to enjoy them.

On materialism: People don’t need enormous cars; they need respect. They don’t need closets full of clothes; they need to feel attractive and they need excitement and variety and beauty. People don’t need electronic equipment; they need something worthwhile to do with their lives. People need identity, community, challenge, acknowledgement, love, joy. To try to fill these needs with material things is to set up an unquenchable appetite for false solutions to real and never-satisfied problems. The resulting psychological emptiness is one of the major forces behind the desire for material growth.

On saving money (a whole chapter on innovative ways to rethink bigger costs): These days, a babysitter for a date night (even a sitter who’s barely older than the child he or she is taking care of) can easily cost more than the dinner out. Find another couple with similar-aged children and try doing a weekly date-night swap. One night a week you watch their kid(s), and the next week they watch yours. You get a date every other week, pay nothing for babysitting, and the kids will likely love playing with their friends every week. Another option is to join a babysitting coop.

A tip on what to do when you no longer need to work: Lifelong learning is a key to happiness. Invest in your ability to survive and thrive and help others and you will never be bored.

On the perfect work life: Even though some people really like their jobs, very few of us can say with honesty that our work lives are perfect. The perfect work life would offer enough challenge to be interesting. Enough ease to be enjoyable. Enough camaraderie to be nourishing. Enough solitude to be productive. Enough hours at work to get the job done. Enough leisure to feel refreshed. Enough contribution to feel needed. Enough silliness to have fun. And enough money to pay the bills . . . and then some.

A summary of the program

These were the most interesting elements of the book for me as I feel I already have a pretty decent handle on the budgeting and investing bits but for anyone that feels they need to start at the beginning, the rest of the book provides an excellent program for anyone to follow no matter what your starting point and current level of financial literacy.

In summary, the 9 step program gets you to:

- Make peace with the past by: calculating how much money you have earned in your lifetime to date as well as figuring out your current net worth (be it positive or negative)

- Be in the present by: calculating your real hourly wage to figure out how much of your life energy you are actually exchanging for your particular job and starting to track all money that enters and leaves your pockets

- Each month, categorise all expenses and convert them into the amount of life energy spent using your real hourly wage calculated in step 2

- Beside each category, each month, ask yourself the 3 questions I mentioned in the first paragraph around fulfillment, life’s purpose, and whether you’d have that expense if you didn’t need to work

- Make life energy visible by: charting your overall income and expenses onto a graph each month. Put it somewhere you can see it everyday. It may serve as a reminder that you are spending more than you are bringing in or vice versa.

- Value your life energy and minimise expenses creating greater fulfillment and alignment in your life – a whole chapter is dedicated to innovative ways to cut back on the typical biggest expenses

- Value your life energy and maximise income – this chapter gives you ideas on how to increase your income

- Each month, in addition to charting your income and expenses, as you start to accumulate capital or passive income from investments, start to also chart this. Once your passive income surpasses your expenses line, you will be financially independent

- Investing for financial independence. A chapter with an intro to investing and how others are generating income in retirement

If this was enough to pique your interest and you can’t find a copy at your local library (I checked the Irish national database and while they have a few of the old version they don’t currently have the 2018 version) then please use this link to buy a copy as a small token of appreciation for my posts as I will get a small commission at no cost to you 🙂

I personally feel the program in this book has the ability to transform many more people’s lives (as it already has). The author’s toured North America for years running these workshops and then through the book. I’m actually reaching out to the author to see if they have a train the trainer type model as I’d love to provide this as an interactive workshop to people looking to change their financial situation as well as their lives in my corner of the world.

1 thought on “Transform your relationship with money”